Ms. Elana is required by her contract of employment to use her own car in the performance

Question:

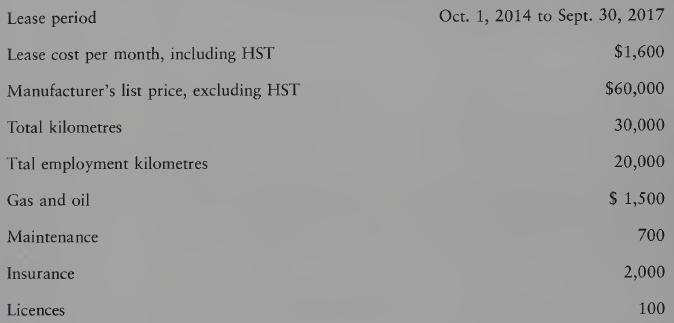

Ms. Elana is required by her contract of employment to use her own car in the performance of her employment duties and to pay for all expenses. Ms. Elana leased a Mercedes from Sky’s-The-Limit Leasing. The following facts relate to the leased Mercedes:

REQUIRED

Determine the amount deductible in respect of the car for the year 2016 on the assumption that a total of $13,893 of leasing costs had been deducted prior to 2016. Assume an HST rate of 14%. Ignore the effects of the leap year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: