Ms. Gina Tang, an employee of Treeline Ltd., which is a registrant for GST/ HST purposes, has

Question:

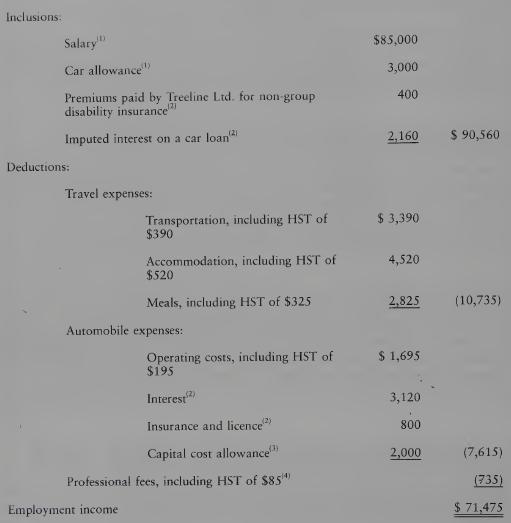

Ms. Gina Tang, an employee of Treeline Ltd., which is a registrant for GST/ HST purposes, has supplied you with the following information concerning her employment income for 2015.

Ms. Tang uses her own car in the performance of her employment duties away from her employer’s place of business and is required by her employment contract to pay for her travel expenses. She is not reimbursed for any of her travel expenses, but she does receive a kilometre allowance. Her employer will certify that it did not consider the allowance to be reasonable at the time it was paid. The example is based on the assumption that her automobile was purchased in early 2015 and was subject to HST at the rate of 13%.

The following information pertains to Ms. Tang’s 2013 employment income as correctly prepared by her accountant. The amount of the expenses indicated reflects all pertinent income tax restrictions (e.g., the limit on capital cost of the automobile, 50% for meals and a proration of employment kilometres to total kilometres). The deductible expenses, where appropriate, include HST, as indicated below.

NOTES

(1) Salary and car allowance are not subject to GST/HST since the definition of property in the ETA excludes money.

(2) Insurance, licence and interest are exempt supplies.

(3) Capital cost allowance is not subject to GST/HST. However, there is a GST/ HST component in the capital cost allowance claimed.

(4) Membership fees in professional organizations of which an employee must be a member to maintain a professional status recognized by statute, are exempt supplies. However, an election is available to these organizations under this provision to deem these fees to be taxable supplies. This election would normally be made where the majority of the members can obtain a refund under either the input tax credit system or rebate system. In addition, the professional organization will also be able to claim an input tax credit on its acquisition of taxable supplies.

REQUIRED

(1) Calculate the amount of GST/HST rebate which Ms. Tang is entitled to receive in 2015.

(2) Indicate the income tax consequences of the GST/HST rebate.

Step by Step Answer:

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett