On May 1, 2016, an unrelated person acquired 60% of the voting shares of Novell Inc. The

Question:

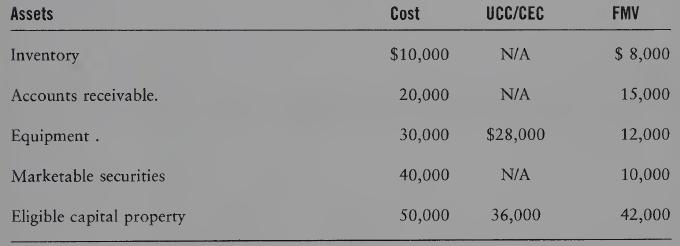

On May 1, 2016, an unrelated person acquired 60% of the voting shares of Novell Inc. The values of the assets owned by Novell Inc. at May 1, 2016, were as follows:

In determining the value of the receivables, the collectibility of each debt was considered individually.

REQUIRED

Which of the accrued (unrealized) losses in the above assets must be recognized by Novell Inc. in determining its income for tax purposes for the deemed year ended April 30, 2016?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: