Robert Baker owns a controlling interest in Six Sixty-One Ltd. and, therefore, is not at arm s

Question:

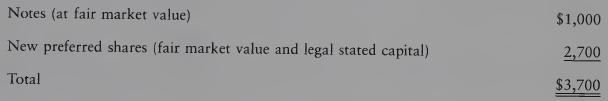

Robert Baker owns a controlling interest in Six Sixty-One Ltd. and, therefore, is not at arm s length with the corporation. His present common shares have a PUC and adjusted cost base of $2,500 and a fair market value of $3,700. The corporation is in the process of reorganizing its capital structure and will exchange these shares for the following package of consideration:

REQUIRED

Determine the tax consequences to Mr. Baker as a result of the capital reorganization.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: