The following 2016 correct computation of taxable income for John Q. Citizen has been prepared for your

Question:

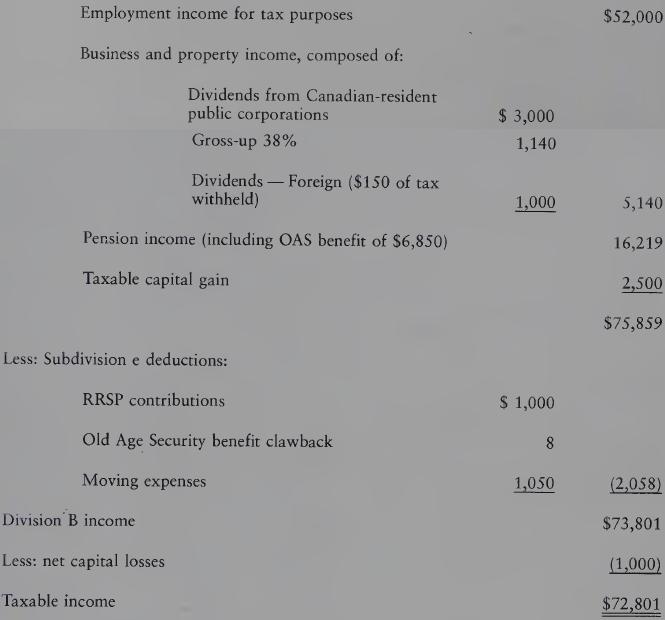

The following 2016 correct computation of taxable income for John Q. Citizen has been prepared for your analysis:

Additional Information

(1) John, age 67, and his wife Jill, age 64, are both resident in your province. Jill has no income and is blind.

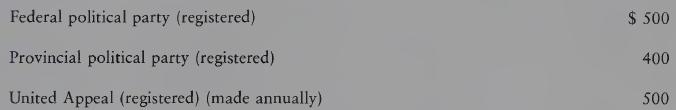

(2) John has made the following selected payments in 2016:

Donations:

(3) John’s employer correctly withheld the following amounts:

(4) John filed his return on April 30, 2017.

REQUIRED

Compute the total amount of federal taxes payable for the year.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Federal Income Taxation In Canada 2016-2017

ISBN: 9781554968725

37th Edition

Authors: Robert E. Beam, Stanley N. Laiken, James J. Barnett

Question Posted: