Question: (3-Year Worksheet, Journal Entries, and Reporting) Jackson Company adopts acceptable accounting for its defined-benefit pension plan on January 1, 2009, with the following beginning balances:

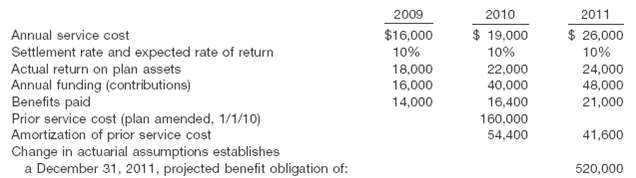

(3-Year Worksheet, Journal Entries, and Reporting) Jackson Company adopts acceptable accounting for its defined-benefit pension plan on January 1, 2009, with the following beginning balances: plan assets $200,000; projected benefit obligation $250,000. Other data relating to 3 years' operation of the plan are shown on the shown below.

(a) Prepare a pension worksheet presenting all 3 years' pension balances and activities.

(b) Prepare the journal entries (from the worksheet) to reflect all pension plan transactions and events at December 31 of each year.

(c) Indicate the pension-related amounts reported in the financial statements for 2011.

Annual service cost Settlement rate and expected rate of return Actual return on plan assets Annual funding (contributions) Benefits paid Prior service cost (plan amended, 1/1/10) Amortization of prior service cost Change in actuarial assumptions establishes a December 31, 2011, projected benefit obligation of: 2009 $16,000 10% 18,000 16,000 14,000 2010 $ 19,000 10% 22,000 40,000 16,400 160,000 54,400 2011 $ 26,000 10% 24,000 48,000 21,000 41,600 520,000

Step by Step Solution

3.40 Rating (169 Votes )

There are 3 Steps involved in it

a Balance Jan 1 2009 Service cost Interest costa Actual return Unexpected lossb Contributions Benefi... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

11-B-A-P-P-B (75).docx

120 KBs Word File