a. When accounting for the relationship of partners inter se, the partnership agreement provides the rules which,

Question:

a. When accounting for the relationship of partners inter se, the partnership agreement provides the rules which, in the first instance, are to be applied.

What information would you expect to find in a partnership agreement to provide such rules, and what should you do if the agreement fails to deal with any aspect of the partnership relationship that affects the financial statements?

b. A, B and C are in partnership, agreeing to share profits in the ratio 4 : 2 : 1. They have also agreed to allow interest on capital at 8 per cent per annum; a salary to C of £5,000 per annum; and to charge interest on drawings made in advance of the year end at a rate of 10 per cent per annum.

A has guaranteed B a minimum annual income of £6,500, gross of interest on drawings.

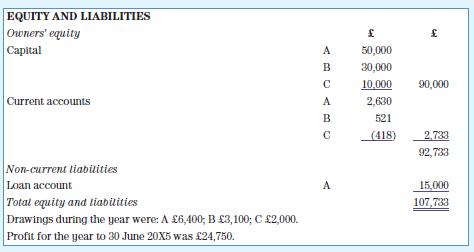

The statement of financial position as at 30 June 20X8 disclosed the following:

You are required to prepare the current accounts for the partners as at 30 June 20X9.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas