Question: Jacobs Ltd has recently completed its draft financial statements for the year ended 30 December 20X9, which showed a draft profit for the year of

Jacobs Ltd has recently completed its draft financial statements for the year ended 30 December 20X9, which showed a draft profit for the year of £300,000. During the audit a number of mistakes and omissions were uncovered. These are listed below.

1. A payment from a credit customer amounting to £7,100 had been received on 27 December 20X9 but had not been banked or included in the financial statements.

2. Depreciation on a non-current asset had been incorrectly calculated. The asset’s cost was £125,000, it was being depreciated on a straight-line basis over four years. £16,250 was charged in the financial statements.

3. Although included in inventory an invoice for goods sold by Jacobs amounting to £17,500, dated 26 December 20X9, had not been included in the financial statements.

4. Two items of inventory, currently valued at a total cost of £35,000, are now considered obsolete. The director estimates that they will only realize about £10,000 between them.

5. The company accountant forgot to include a charge for interest on the 10 per cent long-term loan of £240,000 for the final six months of the year.

6. Rates of £1,500 for the year to 1 April 20X9 were paid for in April 20X8. No entries have been made in the financial statements in relation to this item other than correctly recording the original payment.

7. An item of capital worth £3,000 had been incorrectly entered into the prepayments account instead of non-current assets. The asset has a useful life of three years and a residual value of £600. The accounting policy states that the reducing balance method is most appropriate for this type of asset.

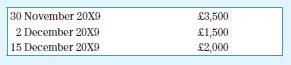

8. One of the credit customers contacted Jacobs Ltd to inform them that the cashier had not given him the correct agreed trade discount of 20 per cent. The invoices affected were noted by the accountant as follows:

Required

a. For each of the items (1) to (8) above, state and describe the effect on the profit for the year and calculate the total effect on Jacobs’ draft profit figure.

b. For each of the items (1) to (8) above, describe the changes, if any, which will have to be made on the statement of financial position of Jacobs Ltd.

30 November 20X9 2 December 20X9 15 December 20X9 3,500 1,500 2,000

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

a 1 This will increase the profit for the year by 7100 as the payment received will now be included in the financial statements The total effect on Ja... View full answer

Get step-by-step solutions from verified subject matter experts