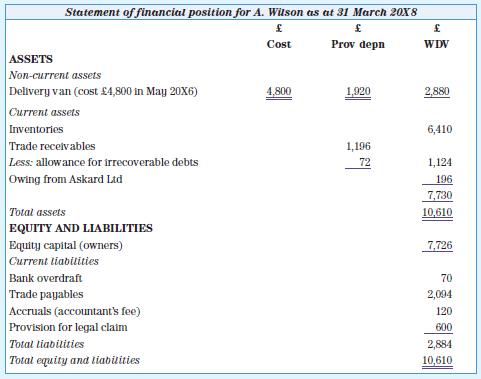

A year ago, you prepared financial statements for A. Wilson, a retailer. His closing position was then:

Question:

A year ago, you prepared financial statements for A. Wilson, a retailer. His closing position was then:

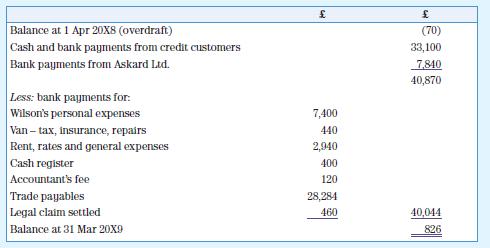

Mr Wilson does not keep full records (despite your advice) and once again you have to use what information is available to prepare his financial statements to 31 March 20X9. The most reliable evidence is a summary of the bank statements for the year. It shows:

For some of the sales Askard credit cards are accepted. Askard Ltd charges 2 per cent commission. At the end of the year the amount outstanding from Askard Ltd was £294.

Some other sales are on credit terms. Wilson keeps copies of the sales invoices in a box until they are settled. Those still in the ‘unpaid’ box at 31 March 20X9 totalled £1,652, which included one for £136 outstanding for four months – otherwise they were all less than two months old.

Wilson thinks he allowed cash discounts of about £150 during the year. The debt of £72 outstanding at the beginning of the year for which an allowance was made was never paid.

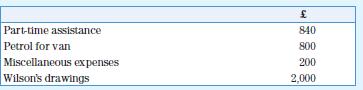

Money received from credit customers and from cash sales were all paid into the bank except that some cash payments were made first. These were estimated as:

Invoices from suppliers of goods outstanding at the year end totalled £2,420. Closing inventory was estimated at £7,090 (cost price) and your fee has been agreed at £200. It has been agreed with the Inspector of Taxes that £440 of the van expenses should be treated as Wilson’s private expenses.

Required

Prepare the statement of profit or loss for Wilson’s business for the year to 31 March 20X9 and a statement of financial position at that date.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas