Jock is a clothing retailer. At 31 December 20X9 he asks you to prepare his final financial

Question:

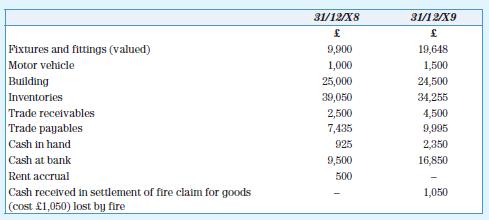

Jock is a clothing retailer. At 31 December 20X9 he asks you to prepare his final financial statements from very incomplete records. You were able to extract the following information from the limited records that were available.

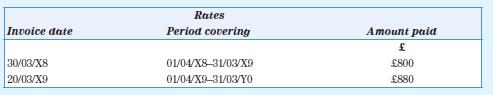

Accruals and prepayments

In addition to the above Jock extracted the following invoices, which need to be adjusted for.

Electricity

Electricity bills are paid for in arrears. The quarters are end of February, May, August and November.

The bill paid on 15 March 20X9 was £315. It is expected that the February 20Y0 bill will be 20 per cent higher than last year’s bill.

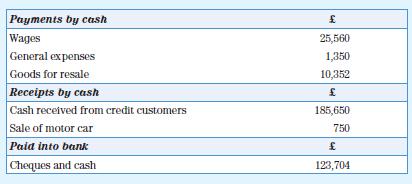

Jock records cash received and paid, except for his own drawings.

Jock’s cash transactions for the year are as follows:

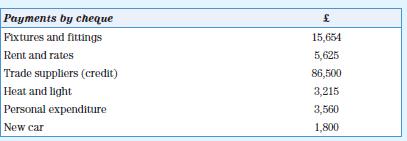

Jock always paid credit suppliers in sufficient time to avail of a cash discount of 5 per cent.

A summary of the cheque payments are as follows:

Jock did not keep a record of his own personal cash takings.

Required

a. Prepare an opening statement of financial position for Jock as at 1 January 20X9.

b. Prepare the sales, purchases, bank, cash, accruals, prepayments (with corresponding expense accounts) and non-current asset adjustment accounts.

c. Draft a statement of profit or loss for the year ended 31 December 20X9 and a statement of financial position at that date.

Step by Step Answer:

Introduction To Financial Accounting

ISBN: 9781526803009

9th Edition

Authors: Anne Marie Ward, Andrew Thomas