1. Suppose Nike produces and sells 500,000 units of the LeBron James Six Chalk Edition shirt. The...

Question:

1. Suppose Nike produces and sells 500,000 units of the LeBron James ‘Six Chalk Edition’ shirt. The selling price is €35 and there is excess capacity to produce an additional 300,000 shirts. The absorption cost of the shirts is €10,000,000, 500,000, or €20 per shirt, consisting of variable manufacturing costs of €7,000,000 (€7,000,000, 500,000 or €14 per shirt) and fixed manufacturing costs of €3,000,000 (€3,000,000, 500,000 or €6 per shirt). Variable selling and administrative costs are €3 per shirt and fixed selling and administrative costs are €2,000,000. Assume Nike receives an offer from Eurosport to buy 100,000 shirts at a price of €18.00 per shirt. If Nike accepts the order, it will not incur any additional variable selling and administrative costs, but it would have to pay a flat fee of €80,000 to the manufacturer’s agent who had obtained the potential order. Should Nike accept the special order?

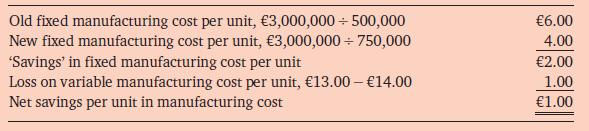

2. What if the order was for 250,000 units at a selling price of €13.00 and there was no €80,000 agent’s fee? One manager argued for acceptance of such an order as follows: ‘Of course, we will lose €1.00 each on the variable manufacturing costs (€13 - €14), but we will gain €2.00 per unit by spreading our fixed manufacturing costs over 750,000 shirts instead of 500,000 shirts. Consequently, we should take the offer because it represents an advantage of €1.00 per shirt.’ The manager’s analysis follows:

Explain why this is faulty thinking.

Step by Step Answer:

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg