A company that uses EVA reported the following results for 20X4 and 20X5 (in millions): Average adjusted

Question:

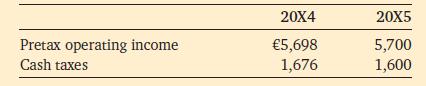

A company that uses EVA reported the following results for 20X4 and 20X5 (in millions):

Average adjusted invested capital was €20,308 million in 20X4 and €18,091 million in 20X5, and the cost of capital was 9 per cent in both 20X4 and 20X5.

1. Compute the company’s EVA for 20X4 and 20X5.

2. Compare the company’s performance in creating value for its shareholders in 20X5 with that in 20X4.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introduction To Management Accounting

ISBN: 9780273737551

1st Edition

Authors: Alnoor Bhimani, Charles T. Horngren, Gary L. Sundem, William O. Stratton, Jeff Schatzberg

Question Posted: