Question: As a performance measurement tool, EVA is oriented more toward cash flows than operating income. Therefore, while calculating EVA, several adjustments are made to operating

As a performance measurement tool, EVA is oriented more toward cash flows than operating income. Therefore, while calculating EVA, several adjustments are made to operating income from the income statement and invested capital from the balance sheet. Common examples include adjustments for R&D, inventory valuation, warranty cost, and cash taxes instead of tax provision as per the income statement.

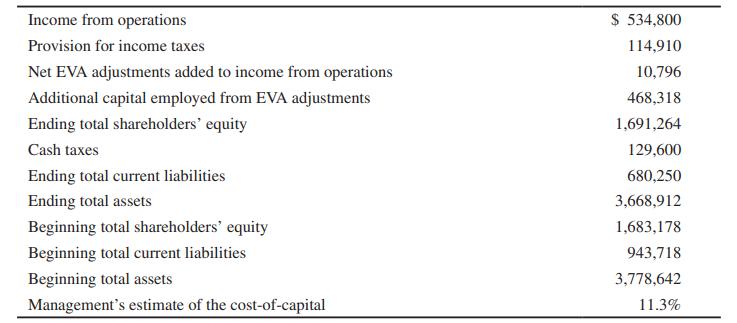

The following data were taken from the 2020 annual report of Megatron Inc:

Prepare a schedule that calculates and compares EVA to economic profit for Megatron Inc.

Income from operations Provision for income taxes Net EVA adjustments added to income from operations Additional capital employed from EVA adjustments Ending total shareholders' equity Cash taxes Ending total current liabilities Ending total assets Beginning total shareholders' equity Beginning total current liabilities Beginning total assets Management's estimate of the cost-of-capital $ 534,800 114,910 10,796 468,318 1,691,264 129,600 680,250 3,668,912 1,683,178 943,718 3,778,642 11.3%

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

ANSWER To calculate EVA for Megatron Inc we need to adjust the income from operations and invested c... View full answer

Get step-by-step solutions from verified subject matter experts