Question: This is an expansion of E14-8. The primary difference between the EVA and residual income measures is the increased focus on cash flow by EVA.

This is an expansion of E14-8. The primary difference between the EVA and residual income measures is the increased focus on cash flow by EVA. EVA companies make several adjustments to both operating income from the income statement and invested capital from the balance sheet. Common examples of these adjustments are inventory adjustments and reporting warranty costs on a cash basis. Most EVA companies make only a few such adjustments (from 5 to 15).

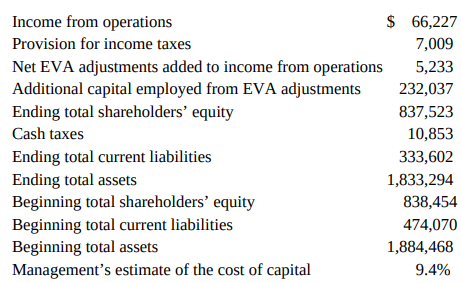

The following data are from the 2008 annual report of Briggs & Stratton (thousands of dollars).

Prepare a schedule that calculates and compares EVA to residual income for Briggs & Stratton.

$ 66,227 Income from operations Provision for income taxes 7,009 Net EVA adjustments added to income from operations Additional capital employed from EVA adjustments Ending total shareholders equity 5,233 232,037 837,523 Cash taxes 10,853 Ending total current liabilities Ending total assets Beginning total shareholders equity 333,602 1,833,294 838,454 Beginning total current liabilities Beginning total assets Management's estimate of the cost of capital 474,070 1,884,468 9.4%

Step by Step Solution

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Income from operations Net adjustments to income for EV... View full answer

Get step-by-step solutions from verified subject matter experts

Document Format (1 attachment)

1941_60505f2d3c56c_791147.xlsx

300 KBs Excel File