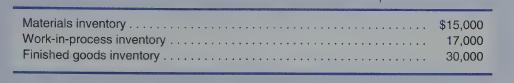

Dillon Manufacturing had the following inventories at December 31, 2018, the end of its fiscal year: During

Question:

Dillon Manufacturing had the following inventories at December 31, 2018, the end of its fiscal year:

During January 2019, the following transactions occurred;

1. Purchased materials on account, \($125,000\).

2. Requisitioned total materials of \($130,000\), of which \($8,000\) was considered indirect materials.

3. Incurred wages payable, \($105,000\).

4. Assigned total wages payable, of which \($15,000\) was considered indirect labor.

5. Incurred other manufacturing overhead, \($57,000\). (Credit Accounts Payable.)

6. Applied manufacturing overhead on the basis of 100% of direct labor costs.

7. Determined ending work-in-process, \($14,000\). Use this information to calculate the amount of WIP transferred to finished goods inventory (credit WIP).

8. Determined ending finished goods, \($26,000\). Use this information to calculate the cost of goods sold (credit FG inventory).

Required

a. Prepare general journal entries to record these transactions.

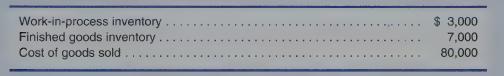

b. If the above transactions covered a full year's operations, prepare a journal entry to dispose of the overhead account balance. Assume that the balance is significant. Also assume that the following accounts contained the indicated amounts of manufacturing overhead applied during 2019:

Step by Step Answer:

Managerial Accounting For Undergraduates

ISBN: 9780357499948

2nd Edition

Authors: James Wallace, Scott Hobson, Theodore Christensen