The capital asset pricing model (CAPM) is described in Exercise 2.16. Use all available observations in the

Question:

The capital asset pricing model (CAPM) is described in Exercise 2.16. Use all available observations in the data file capm 5 for this exercise.

a. Construct \(95 \%\) interval estimates of Exxon-Mobil's and Microsoft's "beta." Assume that you are a stockbroker. Explain these results to an investor who has come to you for advice.

b. Test at the \(5 \%\) level of significance the hypothesis that Ford's "beta" value is one against the alternative that it is not equal to one. What is the economic interpretation of a beta equal to one? Repeat the test and state your conclusions for General Electric's stock and Exxon-Mobil's stock. Clearly state the test statistic used and the rejection region for each test, and compute the \(p\)-value.

c. Test at the \(5 \%\) level of significance the null hypothesis that Exxon-Mobil's "beta" value is greater than or equal to one against the alternative that it is less than one. Clearly state the test statistic used and the rejection region for each test, and compute the \(p\)-value. What is the economic interpretation of a beta less than one?

d. Test at the \(5 \%\) level of significance the null hypothesis that Microsoft's "beta" value is less than or equal to one against the alternative that it is greater than one. Clearly state the test statistic used and the rejection region for each test, and compute the \(p\)-value. What is the economic interpretation of a beta more than one?

e. Test at the \(5 \%\) significance level, the null hypothesis that the intercept term in the CAPM model for Ford's stock is zero, against the alternative that it is not. What do you conclude? Repeat the test and state your conclusions for General Electric's stock and Exxon-Mobil's stock. Clearly state the test statistic used and the rejection region for each test, and compute the \(p\)-value.

Data From Exercise 2.16:-

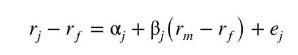

The capital asset pricing model (CAPM) is an important model in the field of finance. It explains variations in the rate of return on a security as a function of the rate of return on a portfolio consisting of all publicly traded stocks, which is called the market portfolio. Generally, the rate of return on any investment is measured relative to its opportunity cost, which is the return on a risk-free asset. The resulting difference is called the risk premium, since it is the reward or punishment for making a risky investment. The CAPM says that the risk premium on security \(j\) is proportional to the risk premium on the market portfolio. That is,

![]()

where \(r_{j}\) and \(r_{f}\) are the returns to security \(j\) and the risk-free rate, respectively, \(r_{m}\) is the return on the market portfolio, and \(\beta_{j}\) is the \(j\) th security's "beta" value. A stock's beta is important to investors since it reveals the stock's volatility. It measures the sensitivity of security \(j\) 's return to variation in the whole stock market. As such, values of beta less than one indicate that the stock is "defensive" since its variation is less than the market's. A beta greater than one indicates an "aggressive stock." Investors usually want an estimate of a stock's beta before purchasing it. The CAPM model shown above is the "economic model" in this case. The "econometric model" is obtained by including an intercept in the model (even though theory says it should be zero) and an error term

a. Explain why the econometric model above is a simple regression model like those discussed in this chapter.

b. In the data file capm5 are data on the monthly returns of six firms (GE, IBM, Ford, Microsoft, Disney, and Exxon-Mobil), the rate of return on the market portfolio \((M K T)\), and the rate of return on the risk-free asset (RISKFREE). The 180 observations cover January 1998 to December 2012. Estimate the CAPM model for each firm, and comment on their estimated beta values. Which firm appears most aggressive? Which firm appears most defensive?

c. Finance theory says that the intercept parameter \(\alpha_{j}\) should be zero. Does this seem correct given your estimates? For the Microsoft stock, plot the fitted regression line along with the data scatter.

d. Estimate the model for each firm under the assumption that \(\alpha_{j}=0\). Do the estimates of the beta values change much?

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim