The data file (b r 2) contains data on 1080 houses sold in Baton Rouge, Louisiana, during

Question:

The data file \(b r 2\) contains data on 1080 houses sold in Baton Rouge, Louisiana, during mid-2005. We will be concerned with the selling price (PRICE), the size of the house in square feet (SQFT), the age of the house in years \((A G E)\), whether the house is on a waterfront ( WATERFRONT \(=1,0\) ), and if it is of a traditional style (TRADITIONAL \(=1,0)\).

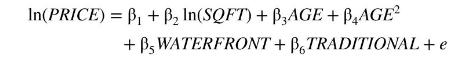

a. Find OLS estimates of the following equation and save the residuals.

At some point, is it possible that an old house will become "historic" with age increasing its value? Construct a \(95 \%\) interval estimate for the age at which age begins to have a positive effect on price.

b. Use the \(N R^{2}\) test for heteroskedasticity with the candidate variables \(A G E, A G E^{2}\), WATERFRONT, and TRADITIONAL. Repeat the test dropping \(A G E\), but keeping \(A G E^{2}\). Plot the least residuals against \(A G E\). Is there any visual evidence of heteroskedasticity?

c. Estimate the model in (a) by OLS with White heteroskedasticity robust standard errors. Construct a 95\% interval estimate for the age at which age begins to have a positive effect on price. How does the interval compare to the one in (a)?

d. Assume \(\sigma_{i}^{2}=\sigma^{2} \exp \left(\alpha_{2} A G E_{i}^{2}+\alpha_{3}\right.\) WATERFRONT \({ }_{i}+\alpha_{4}\) TRADITIONAL \()\). Obtain FGLS estimates of the model in (a) and compare the results to those in (c). Construct a \(95 \%\) interval estimate for the age at which age begins to have a positive effect on price. How does the interval compare to the one in (c)?

e. Obtain the residuals from the transformed model based on the skedastic function in (d). Regress the squares of these residuals on \(A G E^{2}\), WATERFRONT, TRADITIONAL, and a constant term. Using the \(N R^{2}\), is there any evidence of remaining heteroskedasticity in the transformed model? Repeat the test using the transformed model version of the variables and a constant term. How do the results compare?

f. Modify the estimation in (d) to use FGLS with heteroskedasticity robust standard errors. Construct a 95\% interval estimate for the age at which age begins to have a positive effect on price. How does the interval compare to the ones in (c) and (d)?

g. What do you conclude about the age at which historical value increases a house price?

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim