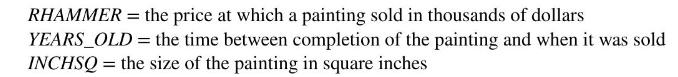

In this exercise, we consider the auction market for art first introduced in Exercise 2.24. The variables

Question:

In this exercise, we consider the auction market for art first introduced in Exercise 2.24. The variables in the data file ashcan_small that we will be concerned with are as follows:

Create a new variable \(I N C H S Q 10=I N C H S Q / 10\) to express size in terms of tens of square inches. Only consider observations where the art was sold \((S O L D=1)\).

a. Estimate the following log-linear equation and report the results:

![]()

b. How much do paintings appreciate on a yearly basis? Find a \(95 \%\) interval estimate for the expected percentage price increase per year.

c. How much more valuable are large paintings? Using a 5\% significance level, test the null hypothesis that painting an extra 10 square inches increases the value by \(2 \%\) or less against the alternative that it increases the value by more than \(2 \%\).

d. Add the variable \(I N C H S Q 10^{2}\) to the model and re-estimate. Report the results. Why would you consider adding this variable?

e. Does adding this variable have much impact on the interval estimate in part (b)?

f. Redo the hypothesis test in part (c) for art of the following sizes: (i) 50 square inches (sixth percentile), (ii) 250 square inches (approximately the median), and (iii) 900 square inches (97th percentile). What do you observe?

g. Find a \(95 \%\) interval estimate for the painting size that maximizes price.

h. Find a \(95 \%\) interval estimate for the expected price of a 75 -year-old, 100-square-inch painting. (Use the estimator \(\exp \left\{E\left[\ln \left(R H A M M E R \mid Y E A R S \_O L D=75, I N C H S Q 10=10\right)\right]\right\}\) and its standard error.)

Data From Exercise 2.24:-

Using data on the "Ashcan School"14 we have an opportunity to study the market for art. What factors determine the value of a work of art? Use the data in ashcan_small. [Note: The file ashcan contains more variables.] For this exercise, use data only on works that sold \((S O L D=1)\).

a. Using data on works that sold, construct a histogram for RHAMMER and compute summary statistics. What are the mean and median prices for the artwork sold? What are the 25th and 75th percentiles?

b. Using data on works that sold, construct a histogram for \(\ln (R H A M M E R)\). Describe the shape of this histogram as compared to that in part (a).

c. Plot \(\ln (\) RHAMMER \()\) against the age of the painting at the time of its sale, YEARS_OLD = DATE_AUCTN - CREATION. Include in the plot the least squares fitted line. What patterns do you observe?

d. Use data on works that sold, estimate the regression \(\ln (R H A M M E R)=\beta_{1}+\beta_{2} Y E A R \_S O L D+e\). Interpret the estimated coefficient of YEARS_OLD.

e. \(D R E C\) is an indicator variable equaling 1 if the work was sold during a recession. Using data on works that sold, estimate the regression \(\ln (R H A M M E R)=\alpha_{1}+\alpha_{2} D R E C+e\). Interpret the estimated coefficient of DREC.

Step by Step Answer:

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim