The data file warner contains daily returns to holding shares in Time Warner Inc. The sample period

Question:

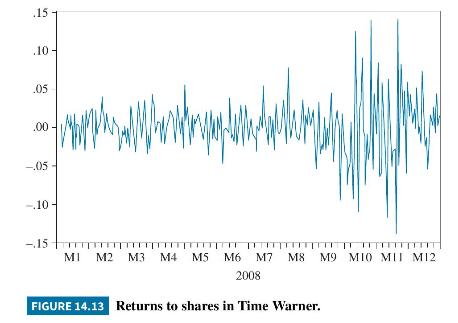

The data file warner contains daily returns to holding shares in Time Warner Inc. The sample period is from January 3, 2008 to December 31, 2008 (260 observations), and a graph of the returns appears in Figure 14.13.

a. Estimate a \(\operatorname{GARCH}(1,1)\) model and an \(\operatorname{ARCH}(5)\) model. Which model would you prefer, and why?

b. What is the expected return next period? The expected volatility next period?

c. Use your preferred model to forecast next period's return and next period's volatility.

d. Do good news and bad news have the same effect on return? On volatility?

Step by Step Answer:

Related Book For

Principles Of Econometrics

ISBN: 9781118452271

5th Edition

Authors: R Carter Hill, William E Griffiths, Guay C Lim

Question Posted: