Question: Using time series data on five different countries, Atkinson and Leigh ({ }^{17}) examine changes in inequality measured as the percentage income share (SHARE) held

Using time series data on five different countries, Atkinson and Leigh \({ }^{17}\) examine changes in inequality measured as the percentage income share (SHARE) held by those with the top \(1 \%\) of incomes. A subset of their annual data running from 1921 to 2000 can be found in the data file inequality.

a. It is generally recognized that inequality was high prior to the great depression, then declined during the depression and World War II, increasing again toward the end of the sample period. To capture this effect, use the observations on New Zealand to estimate the following model with a quadratic trend

![]()

where YEAR \(_{t}\) is defined as \(1=1921,2=1922, \ldots, 80=2000\). Plot the observations on SHARE and the fitted quadratic trend. Does the trend capture the general direction of the changes in SHARE?

b. Find the correlogram of the least-squares residuals from the equation estimated in part (a). How many of the autocorrelations (up to lag 15) are significantly different from zero at a 5\% level of significance?

c. Reestimate the equation in (a) using HAC standard errors. How do they compare with the conventional standard errors? Using first the conventional coefficient covariance matrix, and then the HAC covariance matrix, find \(95 \%\) interval estimates for the expected share in 2001. That is, \(E(\) SHARE \(\mid\) YEAR \(=81)=\beta_{1}+81 \beta_{2}+81^{2} \beta_{3}\). Compare the two intervals.

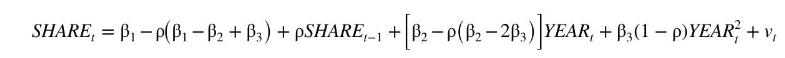

d. Assuming that the errors in (a) follow the \(\mathrm{AR}(1)\) error process \(e_{t}=ho e_{t-1}+v_{t}\), show that the model can be rewritten as YEAR \(\left._{t-1}=Y^{2} E A R_{t}-1\right]\)

e. Estimate the equation in part (d) using nonlinear least squares. Plot the quadratic trend and compare it with that obtained in part (a).

f. Estimate the following equation using OLS and use the estimates of \(\delta_{1}, \delta_{2}, \delta_{3}\), and \(ho\) to retrieve estimates of \(\beta_{1}, \beta_{2}\), and \(\beta_{3}\). How do they compare with the nonlinear least squares estimates obtained in part (e)?

![]()

g. Find the correlogram of the least-squares residuals from the equation estimated in part (f). How many of the autocorrelations (up to lag 15) are significantly different from zero at a 5\% level of significance?

h. Using the equation estimated in part (f), find a 95\% interval estimate for the expected share in 2001. That is, \(E\left(S H A R E_{2001} \mid Y E A R=81\right.\), SHARE \(\left._{2000}=8.25\right)\). Compare this interval with those obtained in part (c).

SHARE, = B + BYEAR, + B3 YEAR + e,

Step by Step Solution

3.58 Rating (148 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts