Question: Using time-series data on five different countries, Atkinson and Leigh investigate the impact of the marginal tax rate paid by high-income earners on the level

Using time-series data on five different countries, Atkinson and Leigh investigate the impact of the marginal tax rate paid by high-income earners on the level of inequality. A subset of their data can be found in the file inequality.

a. Using data on the United States, estimate the equation \(\ln (S H A R E)=\beta_{1}+\beta_{2} T A X+e\) where SHARE is the percentage income share of the top \(1 \%\) of incomes, and TAX is the median marginal tax rate (as a percentage) paid on wages by the top \(1 \%\) of income earners. Interpret your estimate for \(\beta_{2}\). Would you interpret this as a causal relationship?

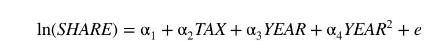

b. It is generally recognized that inequality was high prior to the great depression, then declined during the depression and World War II, increasing again toward the end of the sample period. To capture this effect, estimate the following model with a quadratic trend

where YEAR is defined as \(1=1921,2=1922, \ldots, 80=2000\). Interpret the estimate for \(\alpha_{2}\). Has adding the trend changed the effect of the marginal tax rate? Can the change in this estimate, or lack of it, be explained by the correlations between TAX and YEAR and TAX and YEAR \({ }^{2}\) ?

c. In what year do you estimate that SHARE will be smallest? Find a \(95 \%\) interval estimate for this year. Does the actual year with the smallest value for SHARE fall within the interval?

d. The top marginal tax rate in 1974 was \(50 \%\). Test the hypothesis that, in the year 2000 , the expected \(\log\) income share of the top \(1 \%\) would have been \(\ln (12)\) if the marginal tax rate had been \(50 \%\) at that time.

e. Test jointly the hypothesis in (d) and that a marginal tax rate of \(50 \%\) in 1925 would have led to an expected log income share of \(\log (12)\) for the top \(1 \%\) of income earners.

f. Add the growth rate \((G W T H)\) to the equation in part (b) and re-estimate. Has adding this variable GWTH led to substantial changes to your estimates and test results? Can the changes, or lack of them, be explained by the correlations between GWTH and the other variables in the equation?

g. Using the results from part (f), find point and 95\% interval estimates for the marginal tax rate that would be required to reduce the income share of the top \(1 \%\) to \(12 \%\) in 2001 , assuming \(G W H_{2001}=3\).

In(SHARE) a +, TAX + YEAR+ YEAR+e

Step by Step Solution

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts