Question: A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next: Required a. Using a financial statements model

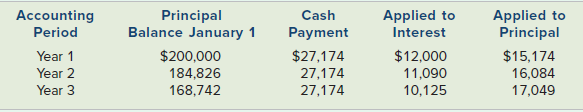

A partial amortization schedule for a 10-year note payable issued on January 1, Year 1, is shown next:

Required

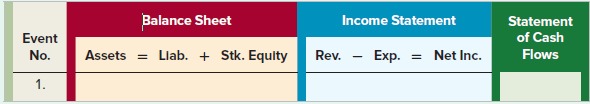

a. Using a financial statements model like the one shown next, record the appropriate amounts for the following two events:

(1) January 1, Year 1, issue of the note payable.

(2) December 31, Year 1, payment on the note payable.

b. If the company earned $62,000 cash revenue and paid $45,000 in cash expenses in addition to the interest in Year 1, what is the amount of each of the following?

(1) Net income for Year 1

(2) Cash flow from operating activities for Year 1

(3) Cash flow from financing activities for Year 1

c. What is the amount of interest expense on this loan for Year 4?

Applied to Principal $15,174 16,084 17,049 Applied to Interest Accounting Principal Balance January 1 Cash Payment $27,174 27,174 27,174 Period Year 1 $200,000 184,826 $12,000 11,090 10,125 Year 2 Year 3 168,742 Balance Sheet Income Statement Event No. Statement of Cash Flows Assets = Llab. + Stk. Equlty Exp. Net Inc. Rev. 1.

Step by Step Solution

3.48 Rating (168 Votes )

There are 3 Steps involved in it

a Effect of Transactions on Financial Statements Balance Sheet Income Statement ... View full answer

Get step-by-step solutions from verified subject matter experts