Consider the following financial statements for Nixon Company. During the year, management obtained additional bond financing to

Question:

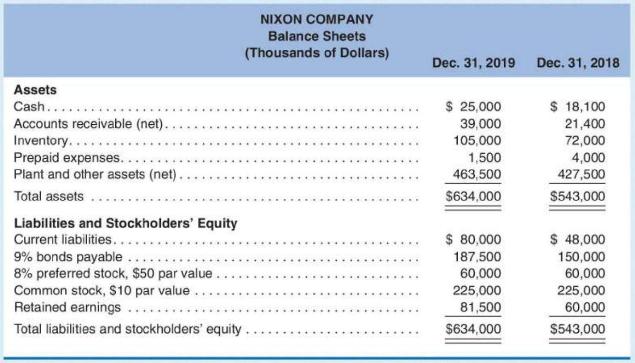

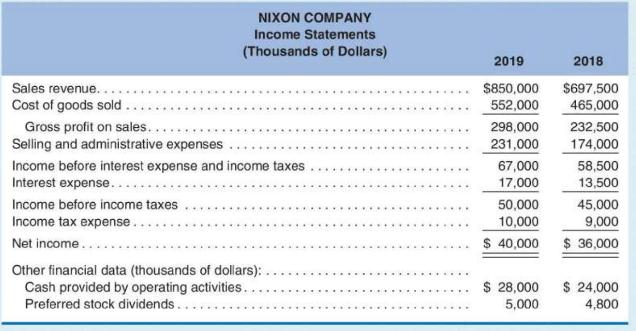

Consider the following financial statements for Nixon Company.

During the year, management obtained additional bond financing to enlarge its production facilities. The plant addition produced a new high-margin product, which is supposed to improve the average rate of gross profit and return on sales.

As a potential investor, you decide to analyze the financial statements:

Required

a. Calculate the following for each year: current ratio, quick ratio, operating-cash-flow-to-currentliabilities ratio (current liabilities were \(\$ 40,000,000\) at January 1,2018 ), inventory turnover (inventory was \(\$ 68,000,000\) at January 1,2018 ), debt-to-equity ratio, times-interest-earned ratio, return on assets (total assets were \(\$ 490,000,000\) at January 1, 2018), and return on common stockholders' equity (common stockholders' equity was \(\$ 265,000,000\) at January 1,2018 ).

b. Calculate common-size percentage for each year's income statement.

c. Comment on the results of your analysis.

Step by Step Answer: