Following is a bank reconciliation for Zocar Enterprises for June 30, Year 1: When reviewing the bank

Question:

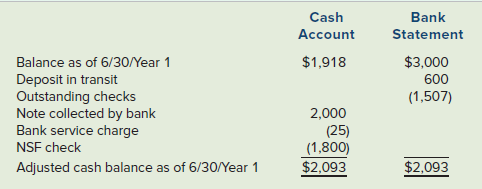

Following is a bank reconciliation for Zocar Enterprises for June 30, Year 1:

When reviewing the bank reconciliation, Zocar’s auditor was unable to locate any reference to the NSF check on the bank statement. Furthermore, the clerk who reconciles the bank account and records the adjusting entries could not find the actual NSF check that should have been included in the bank statement. Finally, there was no specific reference in the accounts receivable supporting records identifying a party who had written a bad check.

Required

a. Prepare the adjustment that the clerk would have made to record the NSF check.

b. Assume that the clerk who prepares the bank reconciliation and records adjustments also makes bank deposits. Explain how the clerk could use a fictitious NSF check to hide the theft of cash.

c. How could Zocar avoid the theft of cash that is concealed by the use of fictitious NSF checks?

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds