Question: Refer to the data given for the Madison Company in Problem P12-3B. Required a. Compute the change in cash that occurred during 2019. b. Prepare

Refer to the data given for the Madison Company in Problem P12-3B.

Required

a. Compute the change in cash that occurred during 2019.

b. Prepare a statement of cash flows using the direct method. Use one cash outflow for "cash paid for wages and other operating expenses." Accounts payable relate to inventory purchases only.

Problem P12-3B

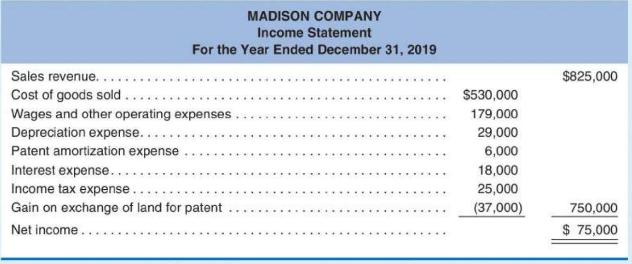

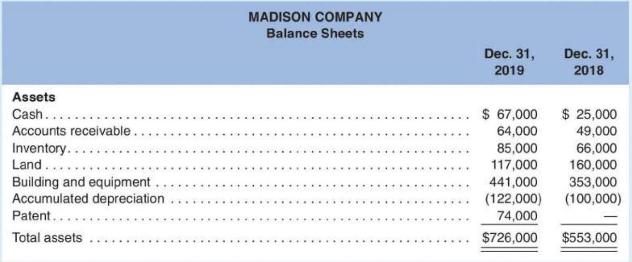

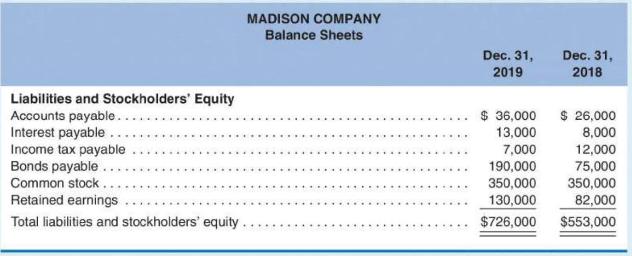

The Madison Company's income statement and comparative balance sheets as of December 31 of 2019 and 2018 follow:

During 2019, \(\$ 27,000\) of cash dividends were declared and paid. A patent valued at \(\$ 80,000\) was obtained in exchange for land. Equipment that originally cost \(\$ 20,000\) and had \(\$ 7,000\) accumulated depreciation was sold for \(\$ 13,000\) cash. Bonds payable were sold for cash and cash was used to pay for structural improvements to the building.

MADISON COMPANY Income Statement For the Year Ended December 31, 2019 Sales revenue..... $825,000 Cost of goods sold... $530,000 Wages and other operating expenses 179,000 Depreciation expense... 29,000 Patent amortization expense 6,000 Interest expense.. 18,000 Income tax expense.. 25,000 Gain on exchange of land for patent (37,000) Net income... 750,000 $ 75,000

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts