The CEO of Evans & Sons, Inc., was considering a lease for a new administrative headquarters building.

Question:

The CEO of Evans \& Sons, Inc., was considering a lease for a new administrative headquarters building. The building was old, but was very well located near the company's principal customers. The leasing agent estimated that the building's remaining useful life was ten years, and at the end of its useful life, the building would probably be worth \(\$ 100,000\). The proposed lease term was eight years, and as an inducement to Smith \& Sons' CEO to sign the lease, the leasing agent indicated a willingness to include a statement in the lease agreement that would allow Smith \& Sons to buy the building at the end of the lease for only \(\$ 75,000\). As the CEO considered whether or not to sign the lease, she wondered whether the lease could be accounted for as a finance lease or an operating lease. What would you advise her?

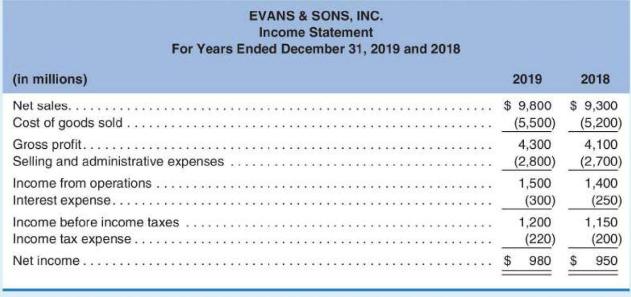

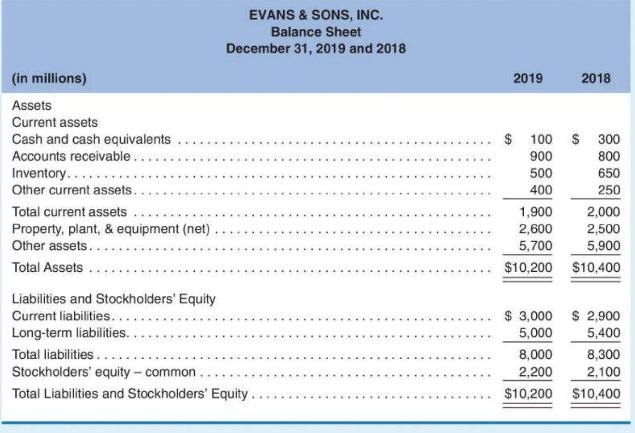

The following information relates to SE10-5 through SE10-7:

Step by Step Answer: