Question:

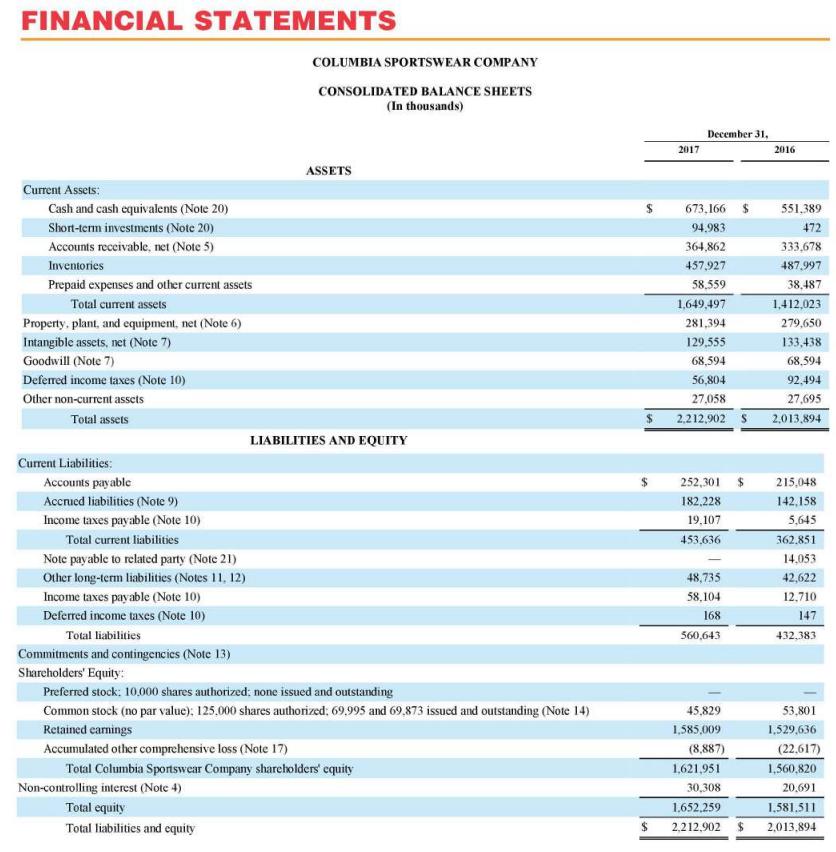

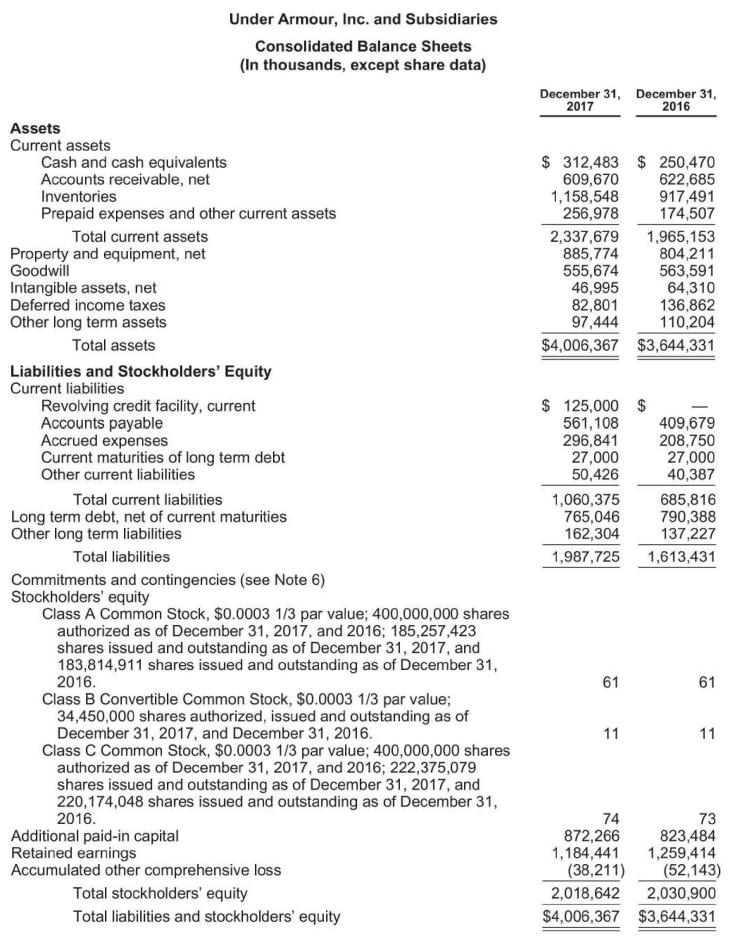

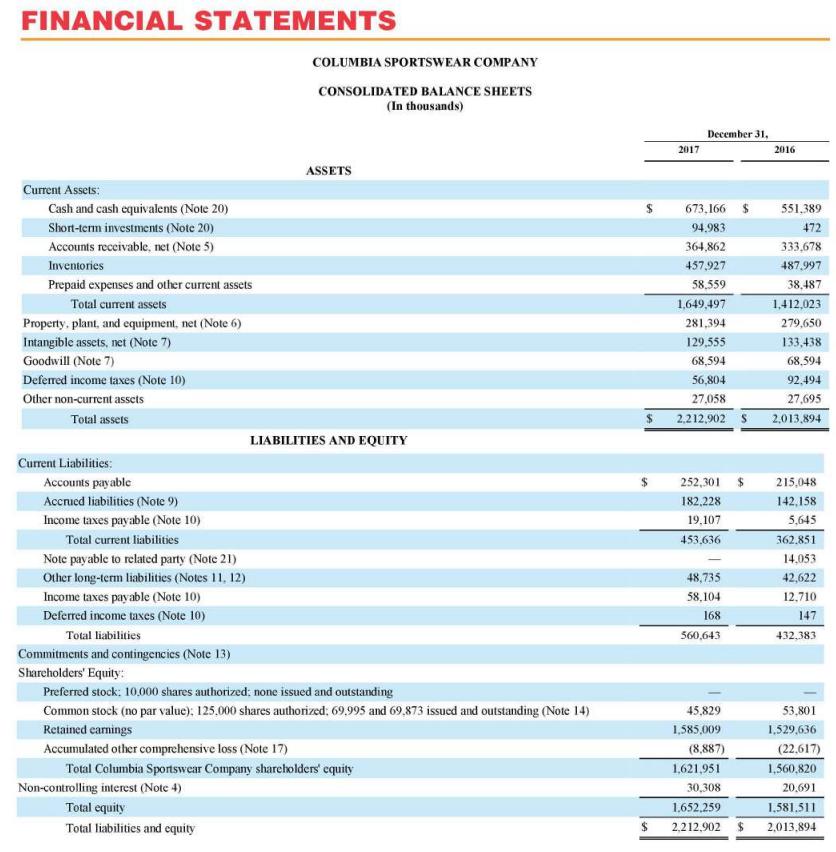

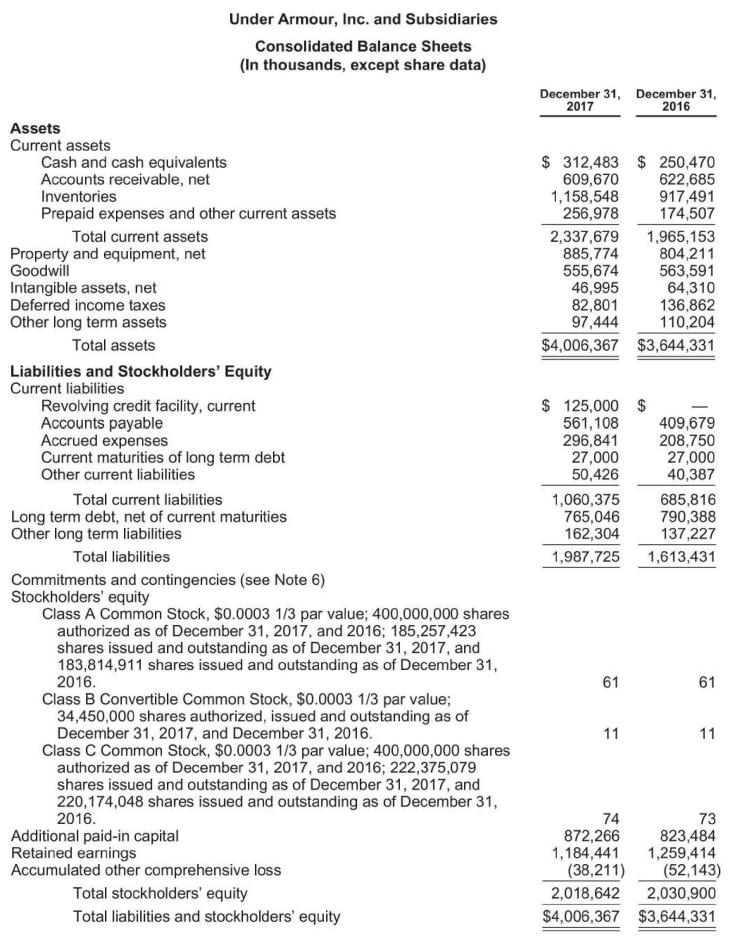

The financial statements for Columbia Sportswear can be found in Appendix A and Under Armour's financial statements can be found in Appendix B at the end of this textbook.

Required

a. Calculate for each company the following ratios for 2017:

1. Current ratio

2. Debt-to-total-assets ratio

3. Return on sales ratio

b. Comment on the companies' relative profitability, liquidity, and solvency.

Appendix A

Appendix B

Transcribed Image Text:

FINANCIAL STATEMENTS COLUMBIA SPORTSWEAR COMPANY CONSOLIDATED BALANCE SHEETS (In thousands) Current Assets: Cash and cash equivalents (Note 20) Short-term investments (Note 20) Accounts receivable, net (Note 5) Inventories Prepaid expenses and other current assets Total current assets Property, plant, and equipment, net (Note 6) Intangible assets, net (Note 7) Goodwill (Note 7) Deferred income taxes (Note 10) Other non-current assets Total assets Current Liabilities: Accounts payable Accrued liabilities (Note 9) Income taxes payable (Note 10) Total current liabilities Note payable to related party (Note 21) Other long-term liabilities (Notes 11, 12) Income taxes payable (Note 10) Deferred income taxes (Note 10) Total liabilities Commitments and contingencies (Note 13) ASSETS December 31, 2017 2016 673,166 $ 551,389 94.983 472 364,862 333,678 457,927 487,997 58,559 38,487 1,649,497 1,412,023 281,394 279,650 129,555 133,438 68,594 68,594 56,804 92,494 27,058 27,695 2,212,902 S 2,013,894 LIABILITIES AND EQUITY 252,301 $ 182,228 215,048 142,158 19,107 5,645 453,636 362.851 14,053 48,735 42,622 58,104 12.710 168 147 560,643 432.383 Shareholders' Equity: Preferred stock: 10,000 shares authorized; none issued and outstanding Common stock (no par value); 125,000 shares authorized; 69,995 and 69.873 issued and outstanding (Note 14) Retained earnings Accumulated other comprehensive loss (Note 17) Total Columbia Sportswear Company shareholders' equity Total equity Non-controlling interest (Note 4) Total liabilities and equity 45,829 53,801 1,585,009 1,529,636 (8,887) (22,617) 1,621,951 1,560,820 30,308 1,652,259 20,691 1.581.511 $ 2,212,902 $ 2,013,894