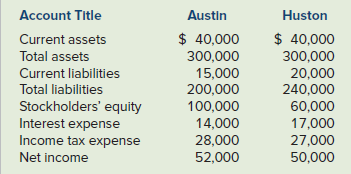

The following information pertains to Austin, Inc. and Huston Company: Required a. Compute each companys debt-to-assets ratio,

Question:

The following information pertains to Austin, Inc. and Huston Company:

Required

a. Compute each company’s debt-to-assets ratio, current ratio, and times interest earned (EBIT must be computed). Identify the company with the greater financial risk.

b. Compute each company’s return-on-equity ratio and return-on-assets ratio. Use EBIT instead of net income when computing the return-on-assets ratio. Identify the company that is managing its assets more effectively. Identify the company that is producing the higher return from the stockholders’ perspective. Explain how one company was able to produce a higher return on equity than the other.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds

Question Posted: