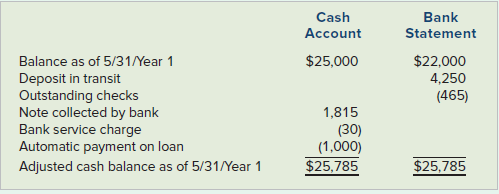

The following is a bank reconciliation for BBQ Express for May 31, Year 1: Because of limited

Question:

The following is a bank reconciliation for BBQ Express for May 31, Year 1:

Because of limited funds, BBQ Express employed only one accountant who was responsible for receiving cash, recording receipts and disbursements, preparing deposits, and preparing the bank reconciliation. The accountant left the company on June 8, Year 1, after preparing the May 31 bank reconciliation. His replacement compared the checks returned with the bank statement to the cash disbursements journal and found the total of the outstanding checks to be $4,600.

Required

a. Prepare a corrected bank reconciliation.

b. What is the total amount of cash missing, and how was the difference between the “true cash” per the bank and the “true cash” per the books hidden on the reconciliation prepared by the former employee?

c. What could BBQ Express do to avoid cash theft in the future?

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds