The following selected transactions apply to Topeca Supply for November and December Year 1. November was the

Question:

The following selected transactions apply to Topeca Supply for November and December Year 1. November was the first month of operations. Sales tax is collected at the time of sale but is not paid to the state sales tax agency until the following month.

1. Cash sales for November Year 1 were $165,000, plus sales tax of 7 percent.

2. Topeca Supply paid the November sales tax to the state agency on December 10, Year 1.

3. Cash sales for December Year 1 were $180,000, plus sales tax of 7 percent.

Required

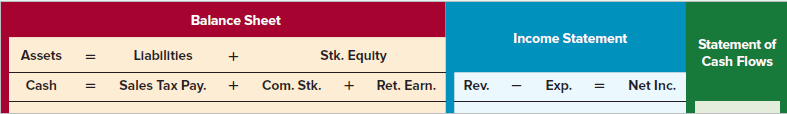

a. Show the effect of the preceding transactions on a horizontal statements model like the one shown next:

b. What was the total amount of sales tax paid in Year 1?

c. What was the total amount of sales tax collected in Year 1?

d. What is the amount of the sales tax liability as of December 31, Year 1?

e. On which financial statement will the sales tax liability appear?

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds