The following transactions pertain to Accounting Solutions Inc. Assume the transactions for the purchase of the computer

Question:

The following transactions pertain to Accounting Solutions Inc. Assume the transactions for the purchase of the computer and any capital improvements occur on January 1 each year.

Year 1

1. Acquired $80,000 cash from the issue of common stock.

2. Purchased a computer system for $35,000. It has an estimated useful life of five years and a $5,000 salvage value.

3. Paid $2,450 sales tax on the computer system.

4. Collected $65,000 in fees from clients.

5. Paid $1,500 in fees to service the computers.

6. Recorded double-declining-balance depreciation on the computer system for Year 1.

7. Closed the revenue and expense accounts to Retained Earnings at the end of Year 1.

Year 2

1. Paid $1,000 for repairs to the computer system.

2. Bought off-site backup services to maintain the computer system, $1,500.

3. Collected $68,000 in fees from clients.

4. Paid $1,500 in fees to service the computers.

5. Recorded double-declining-balance depreciation for Year 2.

6. Closed the revenue and expense accounts to Retained Earnings at the end of Year 2.

Year 3

1. Paid $6,000 to upgrade the computer system, which extended the total life of the system to six years. The salvage value did not change.

2. Paid $1,200 in fees to service the computers.

3. Collected $70,000 in fees from clients.

4. Recorded double-declining-balance depreciation for Year 3.

5. Closed the revenue and expense accounts at the end of Year 3.

Required

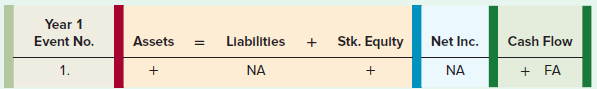

a. Use a horizontal statements model like the following one to show the effect of these transactions on the elements of the financial statements. Use + for increase, − for decrease, and NA for not affected. The first event is recorded as an example.

b. Prepare an income statement, a statement of changes in stockholders’ equity, a balance sheet, and a statement of cash flows for Year 1, Year 2, and Year 3.

Salvage ValueSalvage value is the estimated book value of an asset after depreciation is complete, based on what a company expects to receive in exchange for the asset at the end of its useful life. As such, an asset’s estimated salvage value is an important...

Step by Step Answer:

Introductory Financial Accounting for Business

ISBN: 978-1260299441

1st edition

Authors: Thomas Edmonds, Christopher Edmonds