Each month for the past several years, you have collected the monthly returns to an index of

Question:

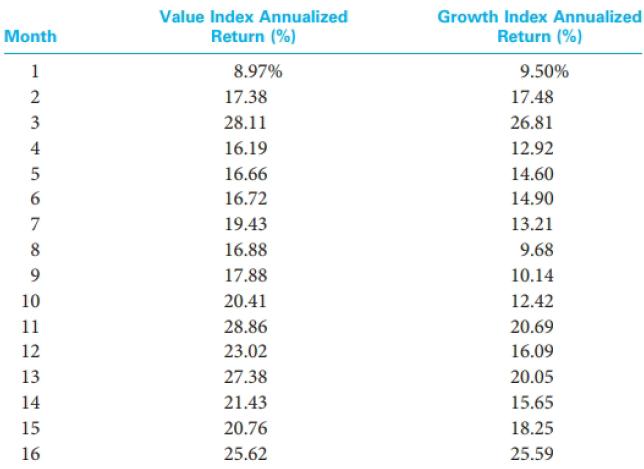

Each month for the past several years, you have collected the monthly returns to an index of large-cap value stocks and an index of large-cap growth stocks. For the last two years, for both of the indexes you have converted these monthly returns into a series of rolling average annualized returns by taking an average of the previous 12 monthly returns and multiplying that average by 12. These rolling average annualized returns are shown below for each index over the past 24 months.

a. For both the value and growth indexes, calculate the arithmetic mean of the 24 monthly average annualized returns. Which index appears to have outperformed the other over this period? Explain.

b. For each month in this sample period, compute the difference in annualized returns between the value index and the growth index (Rvatue - RgroW1h). Calculate the average of this return differential series and compare it to your answers from part (a).

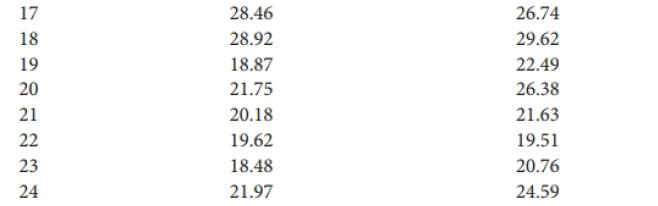

c. Plot the return differential series on a graph similar to Panel A of Exhibit 11.20.

d. The average return differential from part {b) is one way of calculating the risk premium associated with a value investment factor. Interpret this risk premium statistic and explain how it can be seen as the average annualized return earned by a hedge fund following a strategy to go long in value stocks and short in growth stocks.

e. Compute the percentage of the months in the two-year sample period when the rolling average annualized return to the growth index was actually larger than that for the value index. What, if anything, does this tell you about the reliability of the value risk premium over time?

StocksStocks or shares are generally equity instruments that provide the largest source of raising funds in any public or private listed company's. The instruments are issued on a stock exchange from where a large number of general public who are willing...

Step by Step Answer:

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds