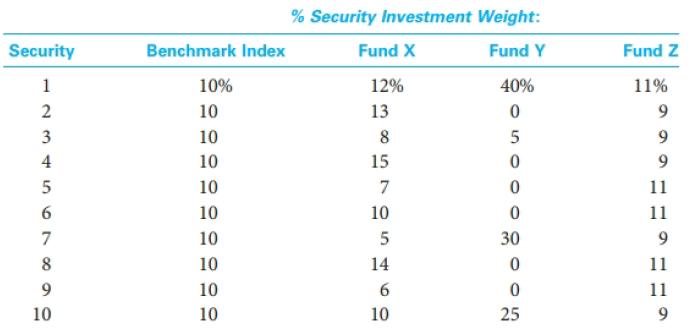

Shown below are the investment weights for the securities held in four different portfolios: three mutual funds

Question:

Shown below are the investment weights for the securities held in four different portfolios: three mutual funds and the benchmark index that each of those funds uses.

a. Calculate the active share (AS) measure for Fund X, Fund Y, and Fund Z relative to the benchmark index.

b. Using these active share calculations, indicate which fund is the most likely to be considered: (i) a passive index fund, (ii) a closet (or enhanced) index fund, and (iii) an actively managed concentrated stock-picking fund. Explain the reason for your classification.

Mutual FundsMutual funds are like a pool of funds gathered by different small investors that have simalar investment perspective about returns on their investments. These funds are managed by professional investment managers who act smartly on behalf of the...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investment Analysis and Portfolio Management

ISBN: 978-1305262997

11th Edition

Authors: Frank K. Reilly, Keith C. Brown, Sanford J. Leeds

Question Posted: