Which of the following statements made by Baders research assistant is correct? A. Statement 1 B. Statement

Question:

Which of the following statements made by Bader’s research assistant is correct?

A. Statement 1 B. Statement 2 C. Statement 3 Judith Bader is a senior analyst for a company that specializes in managing international developed and emerging markets equities. Next week, Bader must present proposed changes to client portfolios to the Investment Committee, and she is preparing a presentation to support the views underlying her recommendations.

Bader begins by analyzing portfolio risk. She decides to forecast a variance–covariance matrix (VCV) for 20 asset classes, using 10 years of monthly returns and incorporating both the sample statistics and the factor-model methods. To mitigate the impact of estimation error, Bader is considering combining the results of the two methods in an alternative target VCV matrix, using shrinkage estimation.

Bader asks her research assistant to comment on the two approaches and the benefits of applying shrinkage estimation. The assistant makes the following statements:

Statement 1. Shrinkage estimation of VCV matrices will decrease the efficiency of the estimates versus the sample VCV matrix.

Statement 2. Your proposed approach for estimating the VCV matrix will not be reliable because a sample VCV matrix is biased and inconsistent.

Statement 3. A factor-based VCV matrix approach may result in some portfolios that erroneously appear to be riskless if any asset returns can be completely determined by the common factors or some of the factors are redundant.

Bader then uses the Singer–Terhaar model and the final shrinkage-estimated VCV matrix to determine the equilibrium expected equity returns for all international asset classes by country. Three of the markets under consideration are located in Country A (developed market), Country B (emerging market), and Country C (emerging market). Bader projects that in relation to the global market, the equity market in Country A will remain highly integrated, the equity market in Country B will become more segmented, and the equity market in Country C will become more fully integrated.

Next, Bader applies the Grinold–Kroner model to estimate the expected equity returns for the various markets under consideration. For Country A, Bader assumes a very long-term corporate earnings growth rate of 4% per year (equal to the expected nominal GDP growth rate), a 2% rate of net share repurchases for Country A’s equities, and an expansion rate for P/

E multiples of 0.5% per year.

In reviewing Countries B and C, Bader’s research assistant comments that emerging markets are especially risky owing to issues related to politics, competition, and accounting standards. As an example, Bader and her assistant discuss the risk implications of the following information related to Country B:

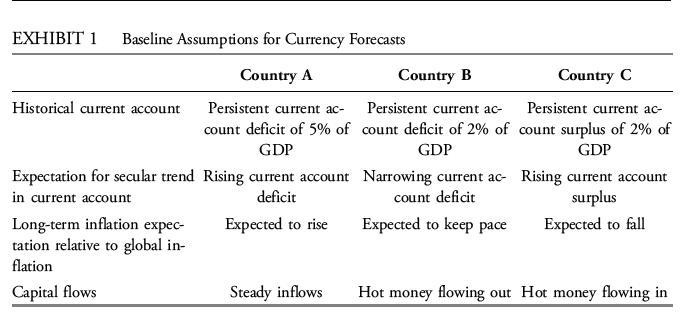

• Experiencing declining per capita income • Expected to continue its persistent current account deficit below 2% of GDP • Transitioning to International Financial Reporting Standards, with full convergence scheduled to be completed within two years Bader shifts her focus to currency expectations relative to clients’ base currency and summarizes her assumptions in Exhibit 1.

During a conversation about Exhibit 1, Bader and her research assistant discuss the composition of each country’s currency portfolio and the potential for triggering a crisis.

Bader notes that some flows and holdings are more or less supportive of the currency, stating that investments in private equity make up the majority of Country A’s currency portfolio, investments in public equity make up the majority of Country B’s currency portfolio, and investments in public debt make up the majority of Country C’s currency portfolio.

Step by Step Answer: