Question: Look again at Example 16.5. What would be the immunizing weights in the second year if the interest rate had fallen to 8%? Example 16.5

Look again at Example 16.5. What would be the immunizing weights in the second year

if the interest rate had fallen to 8%?

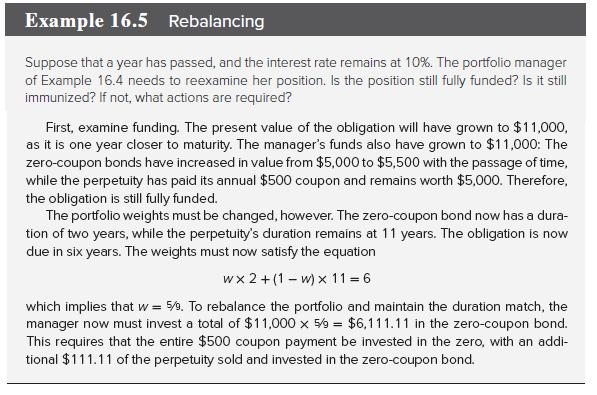

Example 16.5 Rebalancing Suppose that a year has passed, and the interest rate remains at 10%. The portfolio manager of Example 16.4 needs to reexamine her position. Is the position still fully funded? Is it still immunized? If not, what actions are required? First, examine funding. The present value of the obligation will have grown to $11,000, as it is one year closer to maturity. The manager's funds also have grown to $11,000: The zero-coupon bonds have increased in value from $5,000 to $5,500 with the passage of time, while the perpetuity has paid its annual $500 coupon and remains worth $5,000. Therefore, the obligation is still fully funded. The portfolio weights must be changed, however. The zero-coupon bond now has a dura- tion of two years, while the perpetuity's duration remains at 11 years. The obligation is now due in six years. The weights must now satisfy the equation wx2+(1-w) x 11=6 which implies that w = 5/9. To rebalance the portfolio and maintain the duration match, the manager now must invest a total of $11,000 x 5/9 = $6,111.11 in the zero-coupon bond. This requires that the entire $500 coupon payment be invested in the zero, with an addi- tional $111.11 of the perpetuity sold and invested in the zero-coupon bond.

Step by Step Solution

3.39 Rating (161 Votes )

There are 3 Steps involved in it

The perpetuitys durati... View full answer

Get step-by-step solutions from verified subject matter experts