Note that to first (operatorname{order} N(d)=frac{1}{2}+d / sqrt{2 pi}). Use this to derive the value of a

Question:

Note that to first \(\operatorname{order} N(d)=\frac{1}{2}+d / \sqrt{2 \pi}\). Use this to derive the value of a call option when the stock price is at the present value of the strike price; that is, \(S=K e^{-r T}\). Specifically, show that \(C \simeq .4 S \sigma \sqrt{T}\). Also show that \(\Delta \simeq \frac{1}{2}+.2 \sigma \sqrt{T}\). Use these approximations to estimate the value of the call option of Example 15.2.

Data from Example 15.2

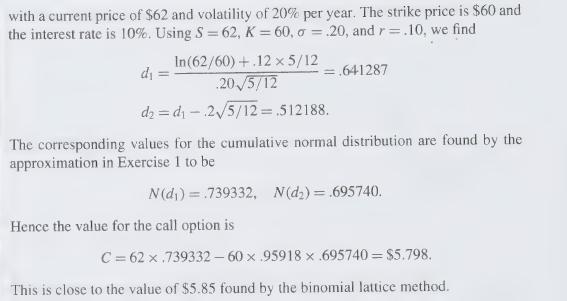

Let us calculate the value of the same option that was a 5-month call option on a stock

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: