Compute the forward delta of a call option based on the normal formula. (The price is given

Question:

Compute the forward delta of a call option based on the normal formula. (The price is given in Section 1.2.4.) Contrast this with the forward delta for an at-the-money (i.e. forward = strike) call option based on the lognormal formula (similar to Question 4 of Chapter 2 but the spot delta is referred to there).

Section 1.2.4.

Question 4

Compute the Black-Scholes delta and gamma for a call-option with payoff max(ST — K,0) at time T.

Section 1.1.2.

Transcribed Image Text:

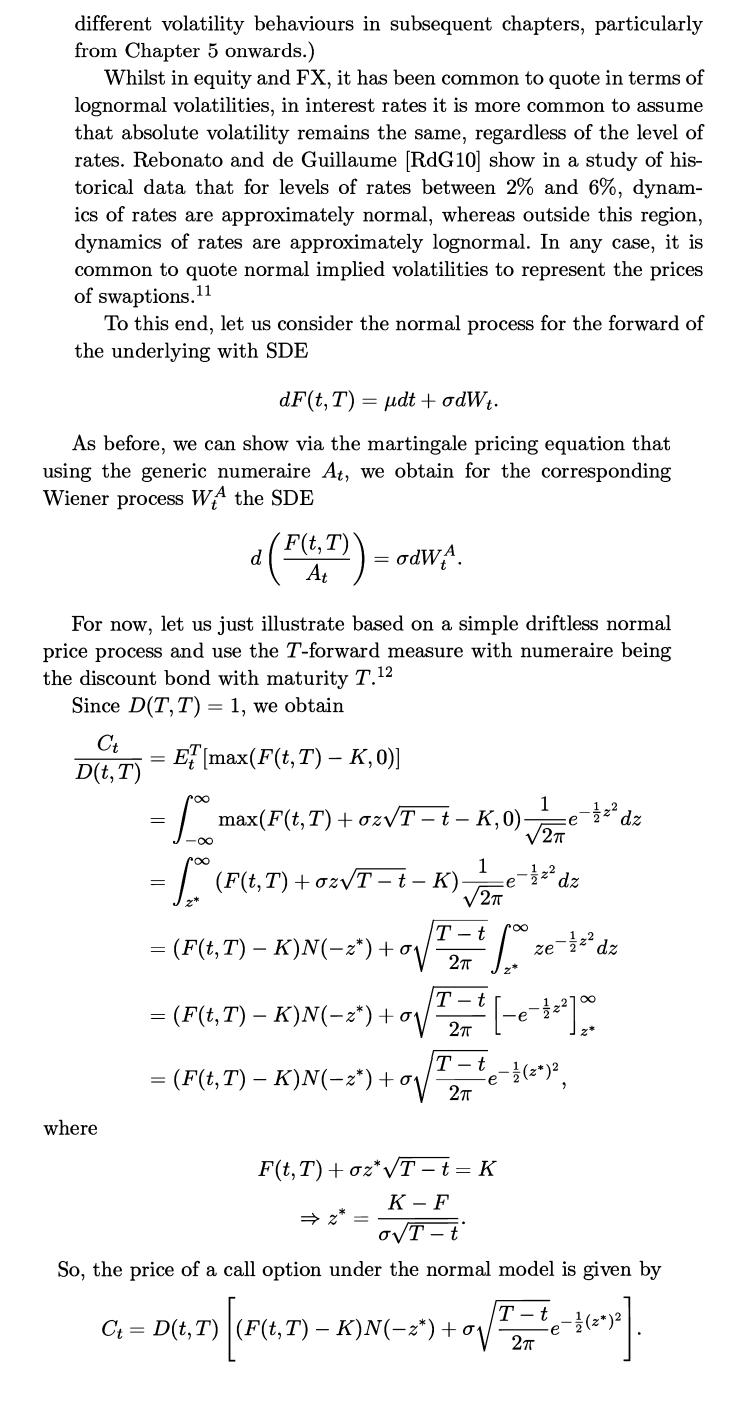

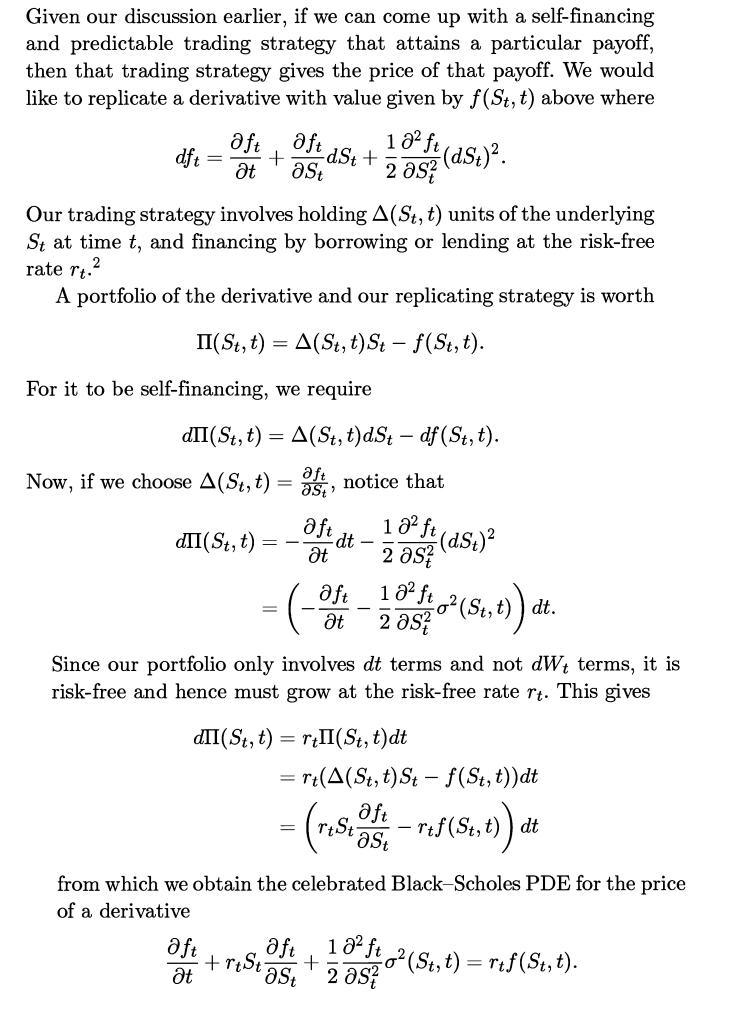

Section 1.1.2 discussed how hedging leads to the elimination of the random component in the value of a hedged portfolio, and hence the Black-Scholes PDE for the price ft of a derivative Delta Notice that this equation does not have a term based on the 'true' drift (St, t) of the underlying St, i.e. it is irrelevant if we think the underlying is likely to appreciate or depreciate in value. That is what hedging is about. However, the volatility term o(St, t) appears in the equation. This is not entirely surprising, since hedging involves maintaining at all times an amount A(St, t) = 3 of the underlying, this amount 1 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0 Ct Bt Implied Vol (%) 50 where changing with St. It follows that the higher the volatility, the more frequent and larger the amount of rebalancing of the portfolio we need. It should be noted that when hedging, we are buying high and selling low. For example, Figure 1.3 shows the delta profile of a Euro- pean call option on a stock below (i.e. an instrument giving one the right to buy the stock at a given strike on the expiry date). The higher the value of the underlying, the greater the value of the option. Hence, to hedge our option, we need to hold a greater amount of the underlying. This means we have to buy more of the stock when its price increases and sell more of the stock when its price decreases. Now, even ignoring transaction costs, and assuming we can trade continuously in size and time, 10 we still need to know when to buy and sell. Suppose we buy if stock increases by an infinitesimal dS and sell when stock drops by the same. Then we will always be buying at S+dS and selling at S-dS. This is guaranteed to cost us money whenever the stock moves. In this way, the value of the option can be seen to be the result of hedging, the cost of which depends on the volatility of the underlying. Let us concern ourselves with the dynamics d where dSt = Stdt + o StdWt. This is a lognormal process for the underlying (i.e. the logarithm of the price of the underlying is normally distributed). For conve- nience, let us suppose we have a constant rate r, then the money market account has value Bt with dBt = r Btdt. Let us take B, as the numeraire, then as per the martingale pric- ing equation, is a martingale under this measure (termed the risk-neutral measure). This means that given the Wiener process WB under the new measure, we have 50 = e where 45 aft t = e 40 35 30 25 + rt St EB 60 X 0.75 = This gives = r, so that dSt = rStdt + SidWP and dlog St (r - 0)dt + odWP (via Ito's Lemma). A call option has payoff CT = max(STK, 0) at time T. This has value = e 1 2 = St St (dSt dBt Bt Bt St Bt = - K = = 0. CT -r(T-t) EB[max (ST - K, 0)] -r(T-t) aft ast fo= St dw. Bt 70 -r(T-t) 1/2 dz 18 ft + o (St, t) = rtf (St, t). 2 ast = e-(T-t) | Ster(T-t) d max = 6 *(7-8) (Se (T-10) (T-1)+0=/T-1 K) - dz -r(T-t) e e 2 2T = e-r(T-t) Ste(-10) (Tt) po ONT + _1__6 #dz 2 Stock Price 80 e Ster 1 -1/2 dz Ct = StN(-z* + oT t) It is more common to write this as = max 0.85 90 and our derivation is along similar looking equation 1 2) [S (T-1) [ / -(2-oT-t) dz - KN(-z*) N(-2)] 2 Ste(0)(T-1)+oz* T-t (-r) :( Ste(-30) (T-1)+0T-1 K,0) and we have used the change of variable y = z oT - t. This gives the celebrated Black-Scholes formula for the price of a call option as :e 2T = e-r(T-t) [Ster(T-t) N(-2*+ oT-t) - KN(-z*)], log 100 St Bt [S(T-0)- dy - KN(-z")] log For completeness, it is worth mentioning that the Black-Scholes for- mula for a put option with payoff PT= max(K - ST, 0) is Pter(T-t) KN(-d + oT- - StN(-d), 1 which we could obtain in the same manner. Whereas we have used deterministic interest rates above, this is not required. If we had stochastic interest rates, it is convenient to work under the T-forward measure, i.e. with the numeraire being the discount bond D(t, T) maturing at time T. This is convenient since at time T, the value of a forward with delivery T is simply the value of the underlying, so that we have CT =max(STK, 0) max(F(T,T) - K, 0) and D(T,T) = 1. This gives via the martingale pricing equation: Ct CT ET D(T,T) D(t, T) ET [max(FT-K, 0)] St dt + o Bt P 110 Ct St N (d) - e-(Tt) KN (d - oT - t), dw B log () + (r + o) (T t) oT-t 1 2T = K (5) - (r - 21/0) (T t) oT-t 0.95 c (F(t,T)e 0(Tt)+ozTt_K,0) = F(t,T)N(z* + oT t) KN(z*), Ct = D(t, T)[F(t, T)N(z* + oT t) KN(z*)]. This explains the earlier remark that to price a vanilla option in equities or FX, it is only the volatility of the forward process that matters. Incidentally, our use of the forward process means we have incorporated equity dividends and the effect of the domestic and foreign rates in our new formulation. e-r(T-t) KN (-z*). It is worth pointing out that whereas the market has long since moved away from a pure lognormal model for equity and FX options, it is common to quote option prices in terms of implied volatilities. This can be seen as an input into a Black box, since a given implied volatility will give a unique price given the rest of the market data (e.g. rates, spot, dividends). After all, the price of a call or put is a monotonic function of implied volatility. There is logic to quoting implied volatilities rather than prices since prices for options of dif- ferent strikes obviously vary a lot more than implied volatilities, so it is easier to visualise an implied volatility surface. Figure 1.4 shows an example of an equity volatility surface. The fact that implied volatilities are different for different strikes suggests that the log- normal model does not adequately capture market dynamics. (We shall explore implied volatility and the models needed to capture (F(RT)) + 21/0 (T t) oT-t the same lines as before, so we get the 1.05 Moneyness = Strike / Spot 1 2 1.15 120 dz 1.25

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

RESHMA SUJITH

Hi,

I am Reshma Sujith.I have completed my M S C Chemistry and B E d from most reputed colleges in Kerala.Teaching is my passion and I love teaching a lot.I worked as a science teacher for secondary school for almost one year.The experience that I got from there,made my interest in teaching a lot more.I always teach my students by connecting with our daily life,which make my teaching unique and different.My Simple tips and tricks to study the most difficult subject will surely help the children to love chemistry a lot.

0.00

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Risk reversals and strangles are described in Section 2.3.2 as packages of calls and puts with strikes on either side of the forward. Using the approximation to the SABR formula per Section 6.2.3,...

-

Derive Dupires formula in Section 5.1.2 in terms of put prices rather than call prices. Section 5.1.2, More interesting is the question of how to recover (St, t) to fit all given market prices. Let...

-

Consider the GARCH(1,1) model Ytayt 1+tt, =w+ay - 1+ Bo 1, where + are independent and identically distributed standard normal random vari- ables. Compute the kurtosis of the series {y} and show it...

-

The 2017 financial statements for the Thor and Gunnar companies are summarized below. These two companies are in the same business and in the same province but in different cities. One-half of Thor?s...

-

Show that in the case of an unbalanced disk, the equation derived in Prob. 16.87 is valid only when the mass center G, the geometric center O, and the instantaneous center C happen to lie in a...

-

1. An investment of P dollars at interest rate r (in decimal form) compounded annually increases to an amount A = P(1 + r)2 in 2 years. An investment of $5000 increases to an amount greater than...

-

Consider an ideal column as in Fig. 13-10d, having one end fixed and the other pinned. Show that the critical load on the column is \(P_{\text {cr }}=20.19 E I / L^{2}\). Hint: Due to the vertical...

-

Data for Henry Company and Mayer Services are given in the following table. Henry Company is considering merging with Mayer by swapping 1.25 shares of its stock for each share of Mayer stock. Henry...

-

define a K-NN model IN PYTHON please 3. Define a K-NN model (1% total grade) Write code to define a K-NN regression model with K-5 and the neighbors are weighted by the inverse of their distance....

-

What problems does redundancy cause?

-

What happens when the relationship between two entities is best defined as many-to-many because one record in one entity relates to many records in the other entity and vice versa? For example, at a...

-

In Problem use interval notation to specify the given interval. {x| x 2 16}

-

Problem 1 - Hill Function (10 marks) The hill function can be used to describe processes that involve cooperative binding events (see page 72). Demonstrate graphically in MATLAB that the process...

-

Reading 1: Please go to the "Guide to the Employment Standards Act" for Ontario. https:// www.ontario.ca/document/your-guide-employment-standards-act-0 Read the following sections for the pages...

-

To request edited captions for the deal/HOH, see hit.... Practice Problem 2 - Basic Probability Boys Girls Total A. P(girl age 5) 5 432 408 840 B. P(any child 7 years old or younger) C. P(boy at...

-

Random walks Consider a random walk on the integers, with transition probs. Pjiji = p Poj- = 9=1-p a) Gambler's ruin: For p-4/3, use a computer to estimate PET 10,000], ie, the probability that you...

-

SPSS Project #2 The goal of this second SPSS project is to learn how to run descriptive statistics, Analysis of Variance (ANOVA), and post-hoc testing for a two-factor study in a statistics program...

-

A screw has a pitch of 0.0200 cm. An effort force of 29.0 N is used to turn a screwdriver whose handle diameter is 36.0 mm. What is the maximum resistance force?

-

Time Solutions, Inc. is an employment services firm that places both temporary and permanent workers with a variety of clients. Temporary placements account for 70% of Time Solutions' revenue;...

-

Propose a mechanism for each of the following reactions: a. b. c. d. ,* ,*

-

Identify reagents that can be used to achieve each of the following transformations: a. b. c. d. e. f. Br Br HO,

-

Draw a Lewis structure for each of the following ions; in each case, indicate which atom possesses the formal charge: a. BH 4 b. NH 2 c. C 2 H 5 +

-

1. A Catamaran is a sailboat with two aerodynamically shaped hulls of equal size. The length of each hull is 14 m and the section submerged in sea water can be approximated by a triangular cross...

-

(a) Identify at least two potential customer segments who would value and want to buy this product, (b) Decide one segment you want to target first and justify why the chosen segment is most suitable...

-

A 14-20 Grade 8 Bolt and Nut is used in a non-permanent connection to clamp two 1.000 inch thick Aluminum plates together. The Modulus of Elasticity of the aluminum plates is E = 10.2 E6 psi and the...

Study smarter with the SolutionInn App