Assume in the previous example that the maintenance margin is 30 percent. If the price of the

Question:

Assume in the previous example that the maintenance margin is 30 percent. If the price of the stock drops to $75, the actual margin percentage will be 40.0 percent [($7,500 − $4,500)/$7,500]. Because this is above the 30 percent maintenance margin requirement, there is no margin call. However, if the price of the stock declines to $60, the actual margin percentage will be 25 percent [($6,000 − $4,500)/$6,000]. This results in a margin call to restore the investor’s equity to the minimum maintenance margin.

Example 5-5

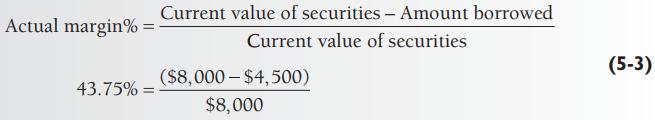

Assume that the maintenance margin is 30 percent, with a 50 percent initial margin, and that the price of the stock declines from $90 to $80 per share. Equation 5-3 is used to calculate actual margin (as a percentage):

Step by Step Answer:

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen