Assume that the expected return on portfolio M is 13 percent, with a standard deviation of 20

Question:

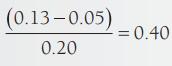

Assume that the expected return on portfolio M is 13 percent, with a standard deviation of 20 percent, and that RF is 5 percent. The slope of the CML is

In our example, a risk premium of 0.40 indicates that the market demands 0.40 percent return for each percent increase in portfolio risk.

Transcribed Image Text:

(0.13-0.05) 0.20 = 0.40

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Answered By

ANDREW KIPRUTO

Academic Writing Expert

I have over 7 years of research and application experience. I am trained and licensed to provide expertise in IT information, computer sciences related topics and other units like chemistry, Business, law, biology, biochemistry, and genetics. I'm a network and IT admin with +8 years of experience in all kind of environments.

I can help you in the following areas:

Networking

- Ethernet, Wireless Airmax and 802.11, fiber networks on GPON/GEPON and WDM

- Protocols and IP Services: VLANs, LACP, ACLs, VPNs, OSPF, BGP, RADIUS, PPPoE, DNS, Proxies, SNMP

- Vendors: MikroTik, Ubiquiti, Cisco, Juniper, HP, Dell, DrayTek, SMC, Zyxel, Furukawa Electric, and many more

- Monitoring Systems: PRTG, Zabbix, Whatsup Gold, TheDude, RRDtoo

Always available for new projects! Contact me for any inquiries

4.30+

1+ Reviews

10+ Question Solved

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted:

Students also viewed these Business questions

-

A 2.6-kip force is applied at Point D of the cast iron post shown. Replace that force with an equivalent force-couple system at the center A of the base section. 2.6 kips 12 in 5 in

-

Ques 1: What is the major complaint by firms concerning the Sarbanes-Oxley act of 2012? A. the legislative maximum allowable compensation for a CEO. B. the legal requirement to disclose project...

-

Assume that the two shares, Share A and Share B, are the only risk-bearing assets available to investors. Assume further that there is a bank that offers an interest rate of 1.51% on invested capital...

-

Consider the following chair conformation of bromocyclohexane: (a) Identify whether the bromine atom occupies an axial position or an equatorial position in the conformation above. (b) Draw a...

-

Tables 18.3(a) and 18.3(b), although pertaining to a real company, are really just a simplified numerical example. What factors would you expect to determine the value of interest tax shields in...

-

Your analysis of the fixed asset accounts at the end of 2010 for the Moen Corporation reveals the following information: 1. The company owns two tracts of land. The first, which cost $18,000, is...

-

Listed below are a number of research questions and hypotheses from actual published articles. For each hypothesis, identify the independent and dependent variable. a. The use of color in a Yellow...

-

Bonds A and B are two straight yen-denominated international bonds, with the same maturity of four years and the same YTM of 9 percent. Bond A has an annual coupon of 11 percent and is accordingly...

-

E3-7 Payroll taxes Davis, Inc. paid wages to its employees during the year as follows: Anderson.... $ 15,400 Bates.... 16,700 Chavez..... 13,000 Devon...... 23,300 Estevez..... 33,200 Franco......

-

In Figure 95, Security As beta of 1.5 indicates that, on average, Security As returns exhibit 1.5 times the average sensitivity to market return changes, both up and down. A security whose returns...

-

Consider the period around the 2008 financial crisis. The stock market hit a record high on October 9, 2007, and officially entered a declining phase by June 30, 2008. The typical U.S. stock index...

-

RadioShack Corporation is a consumer electronics retailer. Recently, the company declared bankruptcy to provide financial protection while attempting to reorganize its operations. Annual report...

-

Make a two flowcharts for my code below: * This class represents a utility for checking the dimensions of a piece of lumber. public class LumberChecker { * This constant represents the maximum...

-

Clara goes ice-skating. In Figure 1 her track is represented by an empty space surrounded by trees on the outside and with a set of trees inside. Figure 1. She trains to become an olympian and...

-

Using your current cost structure and earring price assumptions, create a CVP graph showing cost and revenue data from zero to 750,000 earrings. Clearly indicate the break-even point on the graph....

-

You need to raise investment capital and decide the best method is selling securities (stock'shares of ownership interests) in the corporation you formed by converting from an LLC. Before you do...

-

Client: HCMC Pilates Centre Context: Tam Nguyen is a local entrepreneur and pilates teacher looking to start a business in central of HCMC, Viet Nam or the surrounding areas. Tam Nguyen is a...

-

Mollys Music is an independent record store located in Seattle, Washington. Molly, a self-described music junkie, started her business after she encountered repeated difficulties finding music that...

-

TRUE OR FALSE: 1. Banks with a significantly large share of fixed-interest rate home loans are less exposed to interest rate risks. 2. Although Australian banks are pretty big, they are not...

-

Rachel Schurtz is a high school English teacher. In her spare time, she likes to make her own body lotion, lip gloss, and bath and shower gel. She uses the bath products herself and gives them to her...

-

Emily is an interior decorator who does consulting work for several furniture stores. Additionally, she has been designing and creating rubber stamps for the past several years. She sells the stamps...

-

Chuck, a dentist, raises prize rabbits for breeding and showing purposes. Assume that the activity is determined to be a hobby. During the year the activity generates the following items of income...

-

1. Sheila works as a hotel guest relations, so her job requires a lot of emotional labor. Sheila often thinks about her children when she is at work she focuses on the fun times she's had with them...

-

Below are shown the velocity vs. time graphs for three different objects. In this activity you are asked to read and compare information obtained from these graphs. Assume that all of the objects...

-

Given a voltage source of 10 V and DMM is set up as a Voltmeter. (a) What is the input impedance of the Voltmeter? (b) Draw how you would connect voltmeter for measuring voltage across the resistor.

Study smarter with the SolutionInn App