Figure 195 illustrates the profitloss position for the seller of a put. Assume that a sixmonth put

Question:

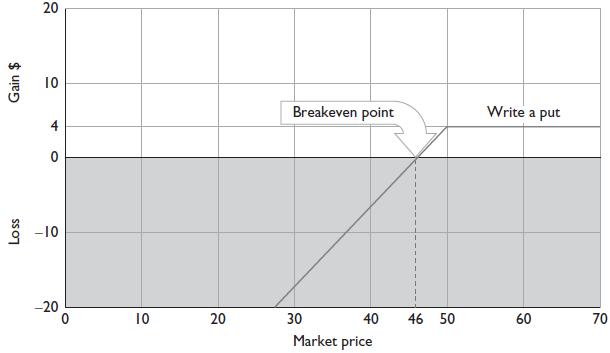

Figure 19‐5 illustrates the profit–loss position for the seller of a put. Assume that a six‐month put is sold at an exercise price of $50 for a premium of $4. The seller of a naked put receives the premium and hopes that the stock price remains at or above the exercise price. The seller begins to lose money below the breakeven point ($50 − $4 = $46). Losses could be substantial if the price of the stock declines sharply. The losses increase point for point as the stock price declines.

Figure 19‐5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted: