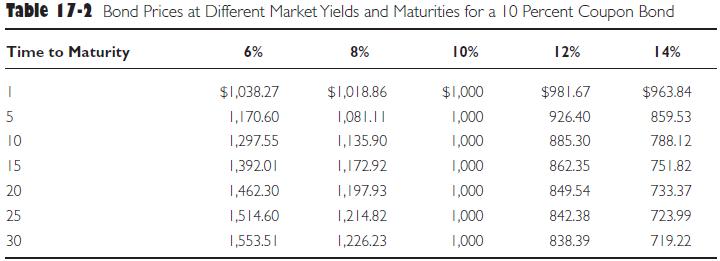

Table 172 shows prices for a 10 percent coupon bond for market yields from 6 to 14

Question:

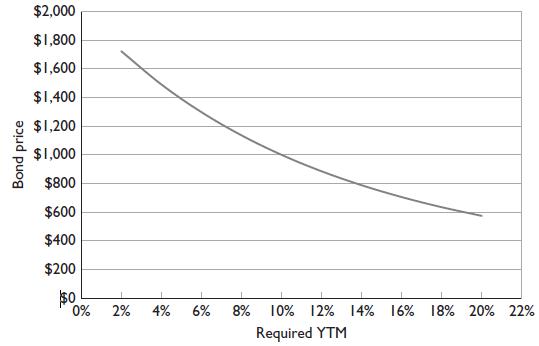

Table 17‐2 shows prices for a 10 percent coupon bond for market yields from 6 to 14 percent and for maturity dates from 1 to 30 years. For any given maturity, if we move from the 10 percent level, the price of the bond declines as the required yield increases and increases as the required yield declines. Figure 17‐5 shows the convex relationship that exists between bond prices and market yields using data from Table 17‐2 for a 10‐year maturity bond.

Table 17‐2

Figure 17‐5

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Investments Analysis And Management

ISBN: 9781118975589

13th Edition

Authors: Charles P. Jones, Gerald R. Jensen

Question Posted: