Monetarists believed for a period of time that the velocity of money was stable within a country.

Question:

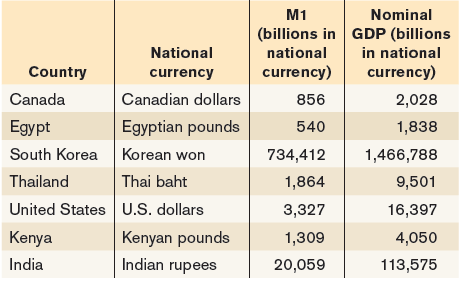

Data from: Statistics Canada, Central Bank of Egypt; Bank of Korea; Bank of Thailand; U.S. Federal Reserve Bank of St. Louis; Central Bank of Kenya; Reserve Bank of India.

a. Calculate the velocity of money for each of the countries. The following table shows GDP per capita for each of these countries in 2016 in U.S. dollars.

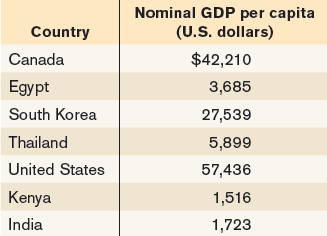

Data from: IMF.

b. Rank the countries in descending order of per capita GDP and velocity of money. Do wealthy countries or poor countries tend to €œturn over€ their money more times per year? Would you expect wealthy countries to have more sophisticated financial systems?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Macroeconomics

ISBN: 978-1319120054

3rd Canadian edition

Authors: Paul Krugman, Robin Wells, Iris Au, Jack Parkinson

Question Posted: