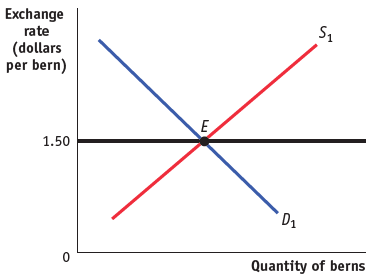

Suppose that Albernias central bank has fixed the value of its currency, the bern, to the Canadian

Question:

The foreign exchange market (also known as forex, FX or the currency market) is an over-the-counter (OTC) global marketplace that determines the exchange rate for currencies around the world. Participants are able to buy, sell, exchange and...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Macroeconomics

ISBN: 978-1319120054

3rd Canadian edition

Authors: Paul Krugman, Robin Wells, Iris Au, Jack Parkinson

Question Posted: