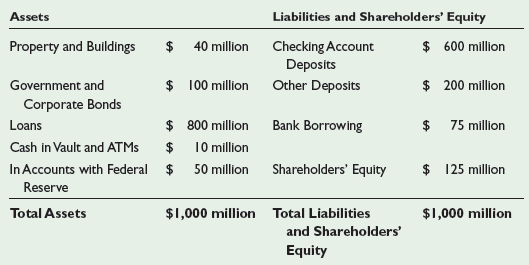

Suppose that Mid-Size National Bank has the balance sheet in the following table, and one day, the

Question:

a. What is Mid-Size€™s leverage ratio now?

b. Suppose Mid-Size wants to bring its leverage ratio back to its original level, by selling assets at their current lower value, and using the proceeds to pay off its debts or reduce its deposits. How much in assets must Mid-Size sell?

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Macroeconomics Principles and Applications

ISBN: 978-1111822354

6th edition

Authors: Robert E. Hall, Marc Lieberman

Question Posted: