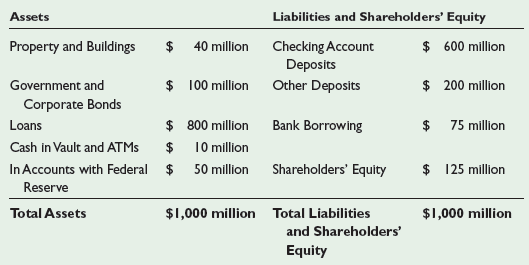

Suppose that Mid-Size Bank has the balance sheet in Table 1, and is required by law to

Question:

a. What percentage of total assets is Mid-Size€™s current level of capital?

b. Suppose Mid-Size issues new shares of stock, which it sells for $75 million. It then lends out the $75 million. Is Mid-Size meeting its capital requirement now? Why or why not?

c. [Harder] How many dollars would Mid-Size have to raise by selling shares of stock to exactly meet its capital requirement? (Assume it will always lend out the proceeds of any stock sale.)

Balance sheet is a statement of the financial position of a business that list all the assets, liabilities, and owner’s equity and shareholder’s equity at a particular point of time. A balance sheet is also called as a “statement of financial...

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Macroeconomics Principles and Applications

ISBN: 978-1111822354

6th edition

Authors: Robert E. Hall, Marc Lieberman

Question Posted: