A group of 12 lifelong friends put together $1,200,000 of their own funds and built a $6,000,000,

Question:

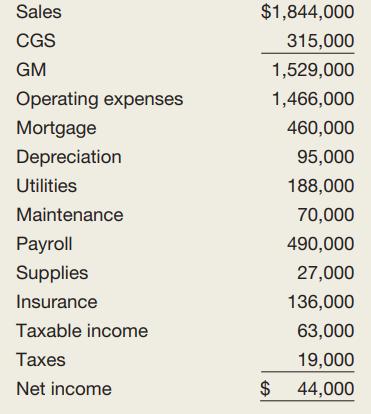

A group of 12 lifelong friends put together $1,200,000 of their own funds and built a $6,000,000, 48-lane bowling alley, near Norfolk, Virginia. Two of the investors became employees of the corporation. Ned Flanders works full-time as General Manager, and James Ahmad, a licensed CPA, serves as Controller on a part-time basis. The beautiful, modern-day facility features a multilevel spacious interior with three rows of 16 lanes on two separate levels of the building, a full-service bar, a small restaurant, a game room (pool, videogames, pinball), and two locker rooms. The facility sits on a spacious lot with plenty of parking and room to grow. The bowling center is located in the small blue-collar town of Wallingford. There is no direct competition within the town. The surrounding communities include a wide-ranging mix of ethnic groups, professionals, middle- to upper-middle-class private homes, and apartment and condominium complexes ranging from singles to young married couples to senior citizen retirement units. Nearly 200,000 people live within 15 miles of Wallingford. The bowling center is open 24 hours per day and has a staff of 27 part- and full-time employees. After four years of operation, the partners find themselves frustrated with the low profit performance of the business. While sales are covering expenses, the partners are not happy with the end-of-year profit-sharing pool. The most recent income statement follows:

The bowling center operates at 100 percent capacity on Sunday through Thursday nights from 6:00 p.m. until midnight. Two sets of men’s leagues come and go on each of those nights, occupying each lane with mostly five-person teams. Bowlers from each league consistently spend money at both the bar and restaurant. In fact, the men’s leagues combine to generate about 60 percent of total current sales. The bowling center operates at about 50 percent capacity on Friday and Saturday nights and on Saturday morning. The Friday and Saturday “open bowling” nights include mostly teenagers, young couples, and league members who come to practice in groups of two or three. The Saturday morning group is a kids’ league, ages 10 through 14. There are four ladies leagues that bowl on Monday and Wednesday afternoons. Business is extremely slow at the bowling center on Monday through Friday and Sunday mornings, and on the afternoons of Tuesday, Thursday, Friday, Saturday, and Sunday. It is not uncommon to have just three or four lanes in operation during those time periods. The owners have taken a close look at the cost side of their business as a way to improve profitability. They concluded that while the total operating expense of $1,466,000 might appear to be high, there was in fact little room for expense cutting. At a recent meeting of the partners, James Ahmad reported on the results of his three-month-long investigation into the operating cost side of other bowling alleys and discovered that the Wallingford Bowling Center was very much in keeping with their industry. James went on to report that bowling alleys were considered to be “heavy fixed cost operations” and that the key to success and profitability lies in maximizing capacity and sales dollars.

QUESTIONS

1. Apply the decision-making process described in the chapter to this case. What is the major problem facing Wallingford? List five specific alternative solutions that could be implemented to solve that major problem.

2. As general manager of this company, how could you utilize and manage the group decision-making process and technique to improve company profits? Which employees would you include in the group?

Step by Step Answer:

Management Leading And Collaborating In The Competitive World

ISBN: 9780078137242

9th Edition

Authors: Thomas Bateman, Scott Snell