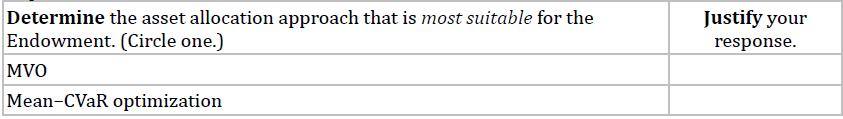

Question: Determine the asset allocation approach that is most suitable for the Endowment. Justify your response. Calixto reviews the endowments future liquidity requirements and analyzes one

Determine the asset allocation approach that is most suitable for the Endowment. Justify your response.

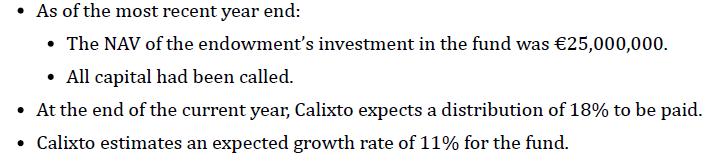

Calixto reviews the endowment’s future liquidity requirements and analyzes one of its holdings in a private distressed debt fund. He notes the following about the fund:

Mbalenhle Calixto is a global institutional portfolio manager who prepares for an annual meeting with the investment committee (IC) of the Estevão University Endowment. The endowment has €450 million in assets, and the current asset allocation is 42% equities, 22% fixed income, 19% private equity, and 17% hedge funds.

The IC’s primary investment objective is to maximize returns subject to a given level of volatility. A secondary objective is to avoid a permanent loss of capital, and the IC has indicated to Calixto its concern about left-tail risk. Calixto considers two asset allocation approaches for the endowment:

mean–variance optimization (MVO) and mean–CVaR (conditional value at risk) optimization.

Determine the asset allocation approach that is most suitable for the Endowment. (Circle one.) MVO Mean-CVaR optimization Justify your response.

Step by Step Solution

3.38 Rating (157 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts