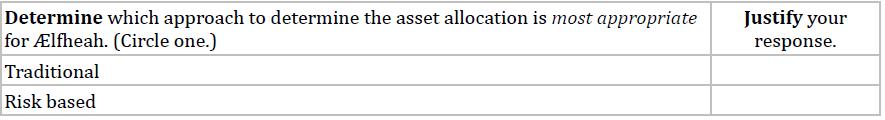

Question: Determine which approach to determine the asset allocation is most appropriate for lfheah. Justify your response. The following year, Ng and the IC review the

Determine which approach to determine the asset allocation is most appropriate for Ælfheah.

Justify your response.

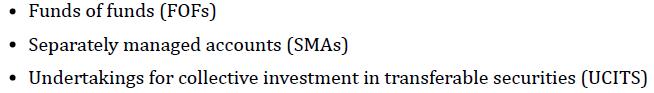

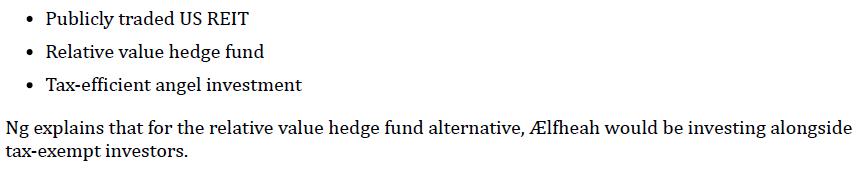

The following year, Ng and the IC review the portfolio’s performance. The IC has gained a better understanding of the investment process. The portfolio is meeting Ælfheah’s liquidity needs, and Ng suggests that Ælfheah would benefit from diversifying into an additional alternative asset class. After discussing suitable investment vehicles for the proposed alternative asset class, Ng proposes the following three investment vehicles for further review:

The Ælfheah Group is a US-based company with a relatively small pension plan. Ælfheah’s investment committee (IC), whose members collectively have a relatively basic understanding of the investment process, has agreed that Ælfheah is willing to accept modest returns while the IC gains a better understanding of the process. Two key investment considerations for the IC are maintaining low overhead costs and minimizing taxes in the portfolio. Ælfheah has not been willing to incur the costs of in-house investment resources. Qauhtèmoc Ng is the investment adviser for Ælfheah. He discusses with the IC its goal of diversifying Ælfheah’s portfolio to include alternative assets. Ng suggests considering the following potential investment vehicles:

Determine which approach to determine the asset allocation is most appropriate for lfheah. (Circle one.) Justify your response. Traditional Risk based

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts