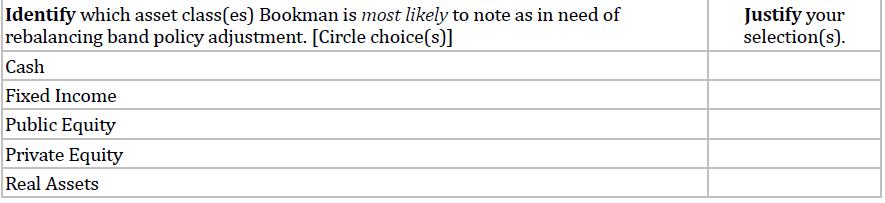

Question: Identify which asset class(es) Bookman is most likely to note as in need of rebalancing band policy adjustment. Justify your selection(s). The investment committee also

Identify which asset class(es) Bookman is most likely to note as in need of rebalancing band policy adjustment. Justify your selection(s).

The investment committee also asks Bookman to investigate whether the endowment should increase its allocation to illiquid investments to take advantage of higher potential returns. The endowment’s liquidity profile policy stipulates that at least 30% of investments must be classified as liquid to support operating expenses; no more than 40% should be classified as illiquid. Bookman decides to perform a bottom-up liquidity analysis to respond to the committee.

Joe Bookman is a portfolio manager at State Tech University Foundation and is discussing the $900 million university endowment with the investment committee.

Exhibit 1 presents selected data on the current university endowment.![need of rebalancing band policy adjustment. [Circle choice(s)] Cash Fixed Income Public](https://dsd5zvtm8ll6.cloudfront.net/images/question_images/1711/7/7/6/0616607a13ddb1431711776060527.jpg)

Identify which asset class(es) Bookman is most likely to note as in need of rebalancing band policy adjustment. [Circle choice(s)] Cash Fixed Income Public Equity Private Equity Real Assets Justify your selection(s).

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts