Senior management at Harriot Industries, an Italian-based fashion house and cosmetics company, have been engaged in a

Question:

Senior management at Harriot Industries, an Italian-based fashion house and cosmetics company, have been engaged in a debate around the best key financial measure relevant to evaluating the performance of senior executives and divisional managers. Currently, the performance of senior managers and divisional managers is based on return on investment (ROI), which forms the basis of the bonus payments, provided ROI increases are achieved each year.

The main source of tension seems to be that some of the accounting staff are pushing for the use of economic value added (EVA) or, at the very least, residual income (RI) to be used at both the senior executive and divisional levels.

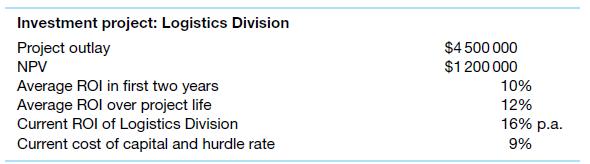

You have been asked to contribute some views. On a recent visit to the head office of Harriot Industries you were able to access details on a printout from a digital whiteboard that represented a discussion about performance measures and a potential investment project in the Logistics Division. Some of this material is provided below.

Required

Using the information provided in the table, demonstrate (perhaps including calculations) the key arguments that might be put forward to support the view that the sole use of return on investment (ROI) may be inappropriate, particularly at the divisional level.

Step by Step Answer:

Management Accounting

ISBN: 9780730369387

4th Edition

Authors: Leslie G. Eldenburg, Albie Brooks, Judy Oliver, Gillian Vesty, Rodney Dormer, Vijaya Murthy, Nick Pawsey